An In-Depth Guide: Explaining Australia’s Gambling Laws in 2024

Legal Disclaimer

This article is for informational purposes only and does not offer legal advice. Contact your attorney to secure advice on any issue or problem. Using this article or any links doesn’t create an attorney-client relationship. The writer’s views do not reflect the opinions of the firm or any individual attorney.

Two governments regulate gambling in Australia. The state government is the brick-and-mortar regulator, while the federal government is the interactive gaming regulator.

Even with the restrictive jurisdictions, Australia is still one of the go-to gambling destinations. The country and its people are known for their love of horse betting and electronic gaming machines, especially pokies.

This article details AU gambling legislation, which includes taxation, restrictions, and penalties. Read to learn why the country is gambling-friendly despite strict regulations.

Highlights of the Article

- Australia is a gambling-friendly country, with a market value of over AU$474.89 billion in 2023.

- Despite the two governing bodies regulating the gambling industry, Australia is experiencing a major health issue—gambling addiction.

- Australia is the biggest gambling loser in the world, amounting to a per capita loss of AU$25 billion.

- Australia regulates its online gambling industry through its Interactive Gambling Act 2001 (IGA).

- The AU online gambling market gained an increased participation rate of 8% in 2023.

- State and territory governments regulate casino gaming and other non-interactive gambling forms.

- Pokies are popular in Australia, especially in NSW, yet lotteries and scratchies have the highest participation rate of 64%.

- It took 15 years for the federal government to have the first amendment of IGA 2001—the Interactive Gambling Act 2016—strengthen the regulatory body.

- Australian winners of any gambling form are not subject to taxation. In contrast, foreigners’ winning payouts will be taxed depending on their countries’ taxation.

- New South Wales has the highest number of imprisonments of up to seven years, with a penalty of AU$110,000 for every unlawful gambling operation.

The Legality of Gambling in Australia

Gambling in Australia is legal, where the lottery and scratchies have the highest participation percentage of 64%. To operate, casinos and sportsbooks in the country are subject to licensing.

Australia has no overarching gambling authority since the State and Territory and the Federal government oversee every activity, comparable to how the US states govern their state laws.

| STATE & TERRITORY GOVERNMENT | FEDERAL GOVERNMENT |

| Regulates land-based gambling and betting | Regulates online gambling and betting |

| Manages lawful and unlawful gambling activities | Focuses on organized crime and foreign investment |

Each state and territory has its separate act within its respective jurisdiction. Meanwhile, the federal government oversees money and trading activities among the states and territories.

Fun Fact

Horse racing is an important aspect in the history of gambling worldwide.

In 1810, horse racing became AU’s first form of gambling. Turf clubs emerged in every capital city in Australia in the 1850s. By 1930, horse racing betting had become legal.

Read further as we dive deep into how the federal, state, and territory levels regulate gambling services and activities in the country.

Interactive Gambling Act 2001 Brings a Paradigm Shift

Australia is among the first countries to legalize online gambling with its Interactive Gambling Act of 2001 (IGA). The IGA regulates iGaming services and prohibits certain services, such as:

- Online casino-style

- Online slot machines

- Online wagering services

Side Note

Australia’s IGA 2011 prohibits the use of digital currency for gambling. However, the Act does not explicitly cover crypto gambling provisions as of March 2024. The country’s crypto gambling scene is slowly rising, with more secure and innovative blockchain casinos emerging to accommodate Aussie gamblers.

The IGA 2001 aims to limit the harmful effects of betting on the AU community. It targets the operators of interactive gambling, not the actual customers. However, there are several exceptions to operating legally in AU:

- Online betting services must have a license before operation but are subject to approval.

- Games not included in the banned or regulated interactive gambling services list may operate without requiring a license.

The table below shows the other gambling legislation enacted by the federal government:

| GAMBLING LEGISLATION | REGULATORY BODY | DEFINITION |

| 1. Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth) (AML/CTF Act) | Australian Transaction Reports and Analysis Centre (AUSTRAC) | Aims to block money laundering and funding of terrorism through gambling. |

| 2. Competition and Consumer Act 2010 (Cth) (CCA) | Australian Competition and Consumer Commission (ACCC) | Protects Australians related to gambling. |

Other regulatory bodies governing gambling activities in Australia at the federal level are as follows:

- Australian Federal Police

- Australian Communications and Medica Authority.

Although the offenses for interactive gambling vary per jurisdiction, the federal dictates the general critical offenses. The authorities ensure that those who contravene the IGA will have substantial penalties.

| IGA OFFENSE | INDIVIDUAL PENALTY | CORPORATE PENALTY |

| Criminal Offense | Up to AU$1.565 million per day | Up to 5x (AU$7.825 million daily) |

| Civil Offense | Up to AU$2,347,500 per day | Up to 5x (AU$11,737,500 daily) |

Continue reading to learn more about the different amendments made in IGA.

The Much-Needed Change: Interactive Gambling Amendments

Before the first law reform, Australians had 24/7 online gambling access. Operators took advantage of technological advancements and innovated more gambling activities.

Gamblers have more gaming options with the variation and modification of online games. As a result, the online gambling industry advanced, reaching AU$7.52 billion in 2023.

Did You Know?

In Australia, online gambling is the fastest-growing gambling sector in the country. The online gambling participation rate had an 8% increase from 2020 to 2022.

Despite the growing industry, the authorities had limited involvement in the gambling regulation. The federal government took 15 years to acknowledge the need to improve the law and fix the loopholes.

The first thing to amend was the enforcement mechanism. The IGA was restructured and strengthened to combat illegal online activities, especially offshore gambling.

Listed in the table are the much-needed changes to the Interactive Gambling Act.

| IGA AMENDMENTS | GAMBLING REFORMS |

| 1. Interactive Gambling Amendment Act 2016 | Defines and clarifies illegal offshore gambling. It strengthens the enforcement powers of the Australian Communications and Media Authority Act 2005. |

| 2. Lottery Betting Act 2018 | Prohibits online lottery and keno betting services for people in Australia. |

| 3. National Self-Exclusion Register Act 2019 | Allows individuals to exclude and ban themselves from all interactive gambling services for a minimum of 3 months to a lifetime. |

| 4. Credit and Other Measures Act 2023 | Bans the use of digital currencies and credit cards as a mode of payment for interactive wagering services. |

Gambling Legislations Across Australia

Gambling provides economic advantages but also causes harm to society. In the 2022 survey, 18.6% of Australians suffered from emotional and psychological problems.

| GAMBLING-RELATED HARM | PERCENTAGE |

| Relationships | 24.9% |

| Health | 20.6% |

| Emotional and Psychological | 18.6% |

| Financial | 15.6% |

| Work or Study | 8.6% |

Australia’s three governing bodies—federal, state, and territory—acknowledge the issue, enacting different legislation.

- Federal government is the Commonwealth’s primary gambling legislator.

- Six states and two territories are the independent gambling regulators.

The following sections detail the laws and regulations of Australia’s eight mainlands, including the taxation of gambling operators.

Side Note

The Australian Constitution, Chapter V Section 109 states that federal law will override state law if that both governments pass conflicting laws on the same subject.

New South Wales

New South Wales regulates pubs, clubs, and casinos to ensure responsible gaming practices. The state’s gambling law protects players and consumers from malicious gambling services through the Unlawful Gambling Act 1998.

The Unlawful Gambling Act 1998 (NSW) outlines the state’s legal and prohibited forms of gambling. Three regulatory bodies manage and ensure the order.

- Liquor & Gaming NSW (L&GNSW) – manages the state’s gambling industry, including taxation. They oversee and enforce the relevant legislation and regulations in the state’s gambling industry.

- Independent Casino Commission (NICC) – is a statutory authority established under the Casino Control Act 1992 amendments in 2022. With increased regulatory oversight, the NICC strictly regulates casinos in NSW.

- Independent Liquor & Gaming Authority (ILGA) – is a decision-maker in liquor, club, and gaming machine regulations.

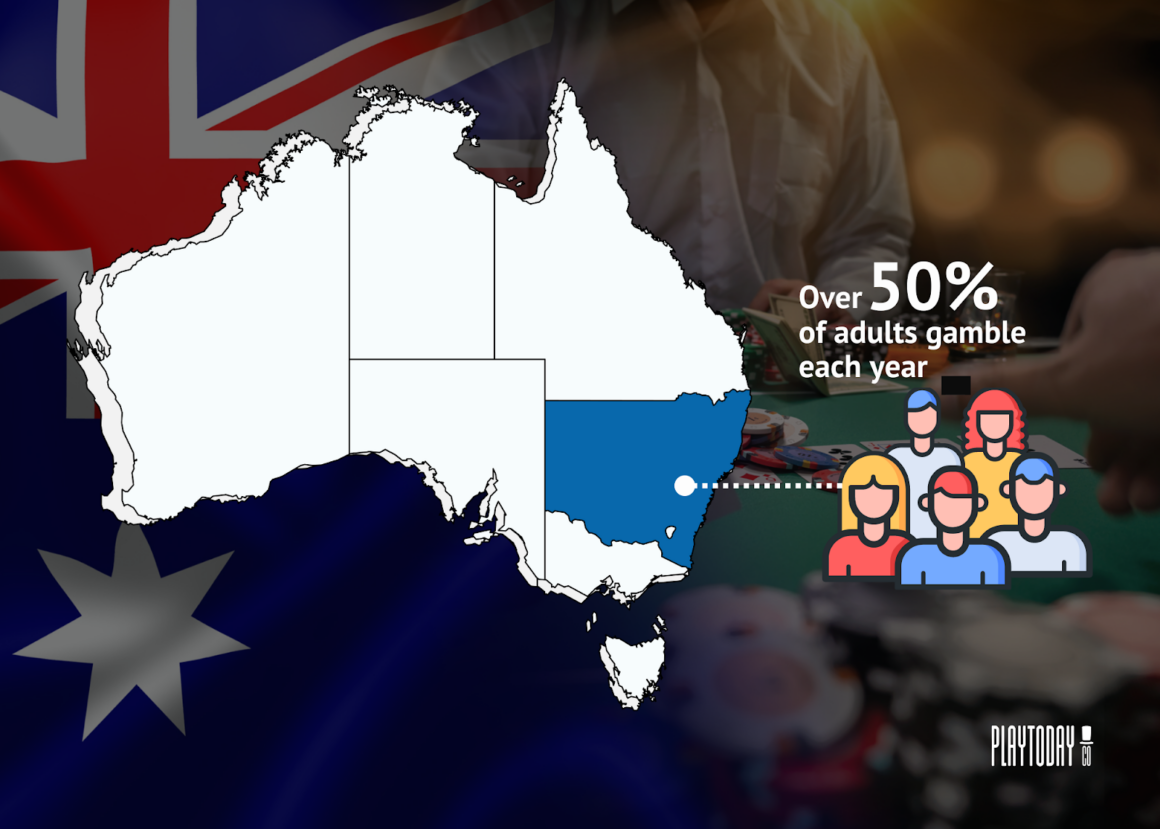

Did You Know?

NSW adults are the biggest gamblers in Australia, with over 50% of the adults gambling each year.

Besides the Unlawful Gambling Act 1998, there are six more enacted provisions to mitigate the adverse effects of gambling.

The table below lists and summarizes the six gambling acts of NSW:

| GAMBLING LEGISLATION | DEFINITION |

| Casino Control Act 1992 (NSW) | Controls casino operations and licensing, which is part of the NSW Gaming and Liquor Administration Act 2007. |

| Community Gaming Act 2018 (NSW) | Takes charge of the conduct of lotteries and other games of chance. |

| Gambling (Two-Up) Act 1998 (NSW) | Legalizes two-up games in certain circumstances. |

| Gaming Machines Act 2001 (NSW) | Manages the gaming machines in hotels and clubs. |

| Public Lotteries Act 1996 (NSW) | Consolidates the conduct of public lotteries. |

| Totalizator Act 1997 (NSW) | Regulates the totalizator betting. |

The gambling tax rates vary based on the activity and service type. However, tax exemption is possible if conditions are met, such as the total quarterly profit or the annual threshold.

Racing & Sports Betting Taxes

- Totalizator

- Tax rate: 3.49%, with a maximum deduction of 25%.

- Commission deduction varies according to bet type.

- The point of consumption tax is 15% on net wagering revenue in excess of the annual tax-free cap of AU$1 million.

- Fixed Odds Betting

- A tax rate of 8.47% of player loss.

- Computer-stimulated racing events: 15%

- Point of Consumption Tax is 15% on net wagering revenue in excess of the annual tax-free capped of AU$1 million.

- Betting Exchange

- 15% on net wagering revenue

Gaming Machine Tax

- Clubs

- An annual tax-free threshold of AU$1 million

- Tax rate above the threshold varies accordingly:

- AU$1m-AU$1.8m: 29.90%

- AU$1.8m -AU$5m: 19.90%

- AU$5m-AU$10m: 24.40%

- AU$10m-AU$20m: 26.40%

- Above AU$20m: 28.40%

- Hotels

- Tax rate ranges from 33% to 50%, based on monthly net gambling revenue.

- A monthly tax-free cap of AU$200,000.

Casino

- Non-Rebate Play: 20.25%

- Poker Machines: tax rate ranges from 46.70% to 60.67%

- Maximum tax-free monthly revenue is AU$2,666.

Lotteries

- 76.918% of player loss

Keno

- 8.91% of player loss

Did You Know?

Half of Australia’s poker machines are found in New South Wales. A flashy “VIP lounge” sign is a not-so-secret code that indicates pokies are available in the establishment.

In 2023, the NSW government announced the removal of all signage promoting gambling. Included phrases are as follows:

– VIP room

– Lounge

– Golden room

– Prosperity lounge

Queensland

Casino gaming is Queensland’s (QLD) most popular gambling activity, with five casino license holders. Of the five, three are considered world-class gambling venues:

- The Star Gold Coast

- Treasury Casino & Hotel

- The Reef Hotel Casino

To regulate QLD’s betting industry, the state designated two regulatory bodies to work closely with each other. The following authorities sit within the Queensland Department of Justice and Attorney-General:

- Queensland Office of Liquor and Gaming Regulation (QOLGR) – responsible for the licensing and compliance of gambling providers.

- Queensland Office of Regulatory Police (QORP) – responsible for creating and enforcing policy and legislative development to minimize the harmful effects of the liquor and gambling industries.

Did You Know?

The majority of the casino players in the state lost more in EGMs. In the FY 2022-2023, the QLDers lost over AU$5 billion, an 11.3% increase from the previous financial year.

The list of Acts below ensures responsible and fair gambling practices in Queensland.

| GAMBLING LEGISLATION | DEFINITION |

| Casino Control Act 1982 | Protects the players and the community by regulating and controlling any casino operations. |

| Charitable and Non-Profit Gaming Act 1999 | Regulates any fundraising gaming activity for charitable and non-profit purposes. |

| Gaming Machine Act 1991 | Ensures the integrity and fairness of gaming machine gambling. |

| Interactive Gambling (Player Protection) Act 1998 | Monitors the interactive gambling activity within the state to minimize the potential harm to the players and the community. |

| Keno Act 1996 | Manages all the Keno activities in the state. |

| Lotteries Act 1997 | Regulates the state’s lotteries activities. |

| Wagering Act 1998 | Monitors the wagering activities in the state. |

Aside from the federal level act, the state has adopted and enacted the Interactive Gambling Player Protection Act 1998. The regulatory body is the QOLGR.

Like other states, Queensland imposes gambling taxes on the operators or providers. Taxes vary depending on the form of gambling activity.

Racing & Sports Betting Taxes

- Totalizator, Fixed Odds Betting, and Betting Exchange

- 15% on net wagering revenue, with a tax-free threshold of AU$300,000.

Gaming Machine Tax

- Clubs

- Tax rate ranges from 17.91% to 35% (post-GST), based on monthly net gambling revenue.

- A monthly tax-free threshold of AU$9,500.

- Hotels

- Tax rate ranges from 3.5% to 20%, based on monthly net gambling revenue.

- A monthly tax-free capped of AU$100,000.

Casino

- Gold Coast and Brisbane Casinos

- Table Games: 20% of monthly gross revenue on table games.

- Fully Automated Table Games: 20%

- Keno: 20%

- Gaming Machines: 30%

- Townsville and Cairns Casinos

- Table Games: 10% of monthly gross revenue on table games.

- FATGs: 10%

- Keno: 10%

- Gaming Machines: 20%

Definition

Lotteries

- Declared Lotteries: 73.48% monthly tax rate.

- Scratch-its: 55% of monthly gross revenue.

Keno

- 29.40% of monthly gross revenue after the casino commissions deduction.

Interactive

- 50% of gross profit

Did You Know?

Queensland held its first lottery in 1916, the Golden Casket Lottery. At that time, lotteries with cash prizes were illegal. For that reason, lottery prizes were sometimes in the form of jewelry.

Even with the cash prohibition, prizes were in gold. Organizers were in charge of finding buyers so that the winners received cash.

As for the proceeds of the first lotteries, QLD donated it to the returning European war veterans and provided housing for war widows.

Some gambling regulations in Queensland have gaming rules that explain the rights and obligations of players and licensed gaming providers.

The following gaming rules are lawful and bound by the gaming acts and regulations:

- Casino Gaming Rule

- Charitable and Non-Profit Gaming Rule 2010

- Keno Rule 2010

- Lotteries Rule

- Wagering Rule 2010

South Australia

Sports betting is South Australia’s most popular gambling activity, and it involves local and international events as well as horse and greyhound racing.

SA is also home to one of the major casinos in the country, the Adelaide Casino. The gambling hub offers a wide range of games for bettors, such as:

- Table games – blackjack, roulette, baccarat, and poker

- Electronic gaming machines – slots and video poker

- Sports betting facilities

Did You Know?

On January 1, 1838, SA held its first legal racing in Thebarton. The racing industry has expanded, contributing AU$89.16 million to the state economy in FY 2022.

In the annual report of Racing SA, the FY22 result shows that several infrastructure projects and new projects have ended. The operating revenue had a 10.5% increase compared to FY21.

Gambling operators in South Australia have one regulatory body under the Attorney-General Department. They enforce gambling regulations and monitor the activities.

- SA Consumer and Business Services (CBS) – monitors and enforces gambling regulations.

The following table shows the five principle Acts in South Australia:

| GAMBLING LEGISLATION | DEFINITION |

| Authorised Betting Operations Act 2000 (SA) | Regulates the totalizator and other betting operations. |

| Casino Act 1997 (SA) | Controls and enforces casino operations in Adelaide. |

| Gambling Administration Act 2019 (SA) | Monitors and controls any gambling activities in SA and is used to repeal the Gambling Administration Act 1995. |

| Gaming Machines Act 1992 (SA) | Ensures a well-regulated supply and operation of gaming machines. |

| Lotteries Act 2019 | Manages the lotteries’ activities in the state and amends the Lottery and Gaming Act 1936. |

Each SA gambling legislation has its subordinate legislation that strengthens the regulations.

- Authorised Betting Operations Regulations 2016 (SA)

- Casino Regulations 2013 (SA)

- Casino Approved Licensing Agreement 2020 (SA)

- Gambling Administration Regulations 2020 (SA)

- Gaming Machines Regulations 2020 (SA)

- Lotteries Regulations 2021

Did You Know?

In FY 2022/2023, South Australia had a total of AU$917.53 billion in Net Gambling Revenue (NGR). The taxes were collected from more than 475 venues in more than 11,652 machines, excluding Adelaide Casino gaming machines.

Aside from regulating the operators and gambling activities, CBS manages the gaming taxation. In SA, taxation depends on the Net Gambling Revenue and the gaming venue:

Racing & Sports Betting Taxes

- Totalizator, Fixed Odds Betting, and Betting Exchange

- 15% on net wagering revenue, with a tax-free threshold of AU$150,000.

Gaming Machine Tax

- Clubs (Non-profit business)

- Tax rate ranges from 21% to 55%, based on annual net gambling revenue.

- Hotels (Profit business)

- Tax rate ranges from 27.50% to 65%, based on annual net gambling revenue.

Casino

- The tax is based on the monthly gross profit earned.

- Table Games: 3.41%

- Fully-Automated Table Gaming: 10.91%

- Gaming Machines: maximum of 41.0%

Lotteries

- 48.9% of net gambling revenue.

Keno

- 61.1% of the monthly gambling revenue.

Tasmania

The Tasmanian government implemented an annual gambling spending limit of AU$5,000 on poker machines. Tasmanian gamblers must apply for a limit increase, subject to approval.

The state government enacted the Gaming Control Act 1993 to ensure a responsible gambling scene. An independent regulatory body regulates the Act:

- Tasmanian Liquor and Gaming Commission – regulates the operators and ensures they adhere to the Act.

The Act regulates gambling activities with the following legislation, as shown in the table below:

| GAMBLING LEGISLATION | DEFINITION |

| Gaming Control Act 1993 | Regulates any gambling form in the state and ensures that gambling is fair and free from criminal influence. |

Tasmania has the lowest number of bettors in the country, the state government follows a well-defined gambling taxation system. The TLCG manages the taxation of the gambling industry.

Tax rates vary depending on the venue and the gambling type. Listed below are the tax rates per gambling activity:

Racing & Sports Betting Taxes

- Totalizator, Fixed Odds Betting, and Betting Exchange

- 15% on net wagering revenue, with a tax-free threshold of AU$150,000.

Gaming Machine Tax

- Clubs

- Electronic Gaming Machines: 32.91%

- Community Support Levy: 4%

- Keno: 20.31%

- Hotels

- Electronic Gaming Machines: 33.91%

- Community Support Levy: 5%

- Keno: 20.31%

Casino

- The tax is based on the monthly gross profit earned.

- Table Games: 0.91%

- Fully-Automated Table Gaming: 5.91%

- Gaming Machines: 10.91%

- Keno: 0.91%

Keno

- 5.88% of gross profit.

Side Note

Tasmania doesn’t have major lottery businesses. Instead, interstate companies run the state. The TAS Government receives the tax collected in VIC and QLD for all lottery tickets sold.

Victoria

Victoria is home to the largest casino in the Southern Hemisphere – the Crown Melbourne. It offers several gambling forms, such as:

- Sports betting.

- Over 2,500 pokies.

- More than 500 table games: Blackjack, Roulette, Baccarat, Poker.

Other famous forms of gambling are the lottery, horse races, and sporting events. VIC enacted five legislations to control any gambling activities within the state.

Did You Know?

In FY 2021-2022, Victoria’s lottery losses increased to 52.12% compared to the previous financial year.

Gambling operators must strictly follow the state’s regulations. The casinos and sportsbooks are legally regulated by the state of Victoria, which has an independent gambling authority:

- Victorian Gambling and Casino Control Commission (VGCCC) – responsible for operator’s licensing and compliance.

With the growing number of operators and increasing gambling activities, Victoria enacted legislation with different gambling scopes.

The table below shows the division of responsibilities among the legislation.

| GAMBLING LEGISLATION | DEFINITION |

| 1. Casino Control Act 1991 | Manages the casino operation in Victoria. |

| 2. Casino (Management Agreement) Act 1993 | Details the casino management agreement between the state of Victoria and Crown Melbourne. |

| 3. Gambling Regulation Act 2003 | Regulates and imposes responsible gambling in the state. |

| 4. Victorian Gambling and Casino Control Commission Act 2011 | Has created the VGCCC, which regulates the gambling industry in the state. |

| 5. Victorian Responsible Gambling Foundation Act 2011 | Has established the Victorian Responsible Gaming Foundation, which helps reduce the adverse effects related to gambling. |

Victoria’s taxation rates depend on the gambling type and forms–wagering and betting, keno, and casino. The following details the taxes per gambling form:

Racing & Sports Betting Taxes

- Totalizator, Fixed Odds Betting, and Betting Exchange

- 10% tax on net wagering revenue, with a tax-free threshold of AU$1 million.

Gaming Machine Tax

- Clubs

- Tax rate varies per gaming revenue

- Tax ranges from 46.70% to 60.67%

- $2,666 is the monthly revenue threshold (tax-free)

- Hotels

- Rates range from 8.33% to 65%

- Varies per gaming machine progressive rate scale

Casino

- Regular Players EGMs: Rate reaches 31.57% of gross gaming revenue

- Table Games: 21.25% of gross gaming revenue.

- Community Benefit Levy: A tax rate of only 1% of gross gaming revenue.

Lotteries

- Tax rates vary from 79.4% to 90%

Soccer

- 57.52% of player loss.

Keno

- 24.24% of player loss. No tax-free threshold.

Quick Tip

Starting in July 2024, Victoria’s gambling tax will increase from 10% to 15% of the net wagering revenue. The tax-free threshold of AU$1 million will remain.

Western Australia

Unlike the other states and territories, Western AU doesn’t have gaming machines in clubs and hotels. However, online wagers and sports bets are allowed. Even betting on local and international sports events is legal.

To ensure that the gambling activities in WAS are in order, the State Department and the body work together:

- Western Australia Department of Racing, Gaming, and Liquor – is responsible for creating policies, issuing licenses, and enforcing regulations.

- Western Australia Gaming and Wagering Commission – administers the casino, gaming, and wagering activities.

The following table shows the different gaming, wagering, and racing legislation in Western Australia:

| GAMBLING LEGISLATION | DEFINITION |

| 1. Betting Control Act 1954 | Authorizes and controls the totalisation and betting activities. |

| 2. Casino (Burswood Island) Agreement Act 1985 | Implements the agreement between the State of Western Australia and the Burswood Property Trust to establish a casino complex at Burswood Island. |

| 3. Casino Control Act 1984 | Provides licensing to the operators and controls the gaming operations. |

| 4. Gaming and Betting (Contracts and Securities) Act 1985 | Amends and consolidates agreements and securities related to gaming and betting. |

| 5. Gaming and Wagering Commission Act 1987 | Consolidates and amends the law related to gaming and wagering. |

| 6. Racing and Wagering Legislation Amendment Act 2009 | Amends the following legislation:- Betting Control Act 1954- Gaming and Wagering Commission Act 1987- Racing and Wagering Western Australia Act 2003 |

| 7. Racing Bets Levy Act 2009 | Outlines the requirements of the betting operators who use or publish WA race fields. |

| 8. Racing Penalties Appeal Act 1990 | Authorizes the Racing Penalties Appeal Tribunal of WAS to create appeals against penalties imposed in disciplinary proceedings. |

| 9. Racing Restriction Act 2023 | Regulates horse and greyhound races and race meetings and prohibits other animal racing in public. |

| 10. The Western Australian Turf Club Act 1892 | Enables the members to sue and be sued. |

| 11. Western Australian Turf Club (Property) Act 1944 | Resolves doubts concerning the power of the Club. |

| 12. Western Australian Trotting Association Act 1946 | Establishes the Association’s objectives, purposes, and powers for harness racing. |

| 13. Western Australian Greyhound Racing Association Act 1981 | Establishes the Association’s powers for incidental purposes. |

Three of the gambling legislation have regulations under it.

- Betting Control Regulation 1978

- Casino Control Regulations 1999

- Gaming and Wagering Commission Regulations 1988

Quick Tip

Live or in-play betting is strictly prohibited in Western Australia. Bets must be placed before the event and cannot be made during it.

Taxation rates in Western Australia depend on the gambling type and forms–wagering and betting, keno, and casino.

Racing & Sports Betting Taxes

- Totalizator, Fixed-odd betting, & Betting exchange

- 15% tax rate for those that exceed the tax-free threshold of AU$150,000

Casino

- Gaming machines: 12.42% of player loss

- Fully Automated Gaming Machines: 12.92% of player loss

- Table Games & Keno: 9.37% of player loss

Lotteries

- State Pool Account: 40% of net subscriptions

- Sports Lotteries Account: 5%

- Arts Lotteries Account: 5%

- Eligible Organizations: 12.50%

- Festival of Perth & WA Film Industry: 5%

Other Gambling Taxes

- Racing Bets Levy:

- 1% tax rate. The annual threshold is AU$3 million, and new rates will apply, depending on the value.

Fun Fact

Alan Woods was an Australian mathematical genius and the master of quantitative betting. He collaborated with his fellow gambler and mathematician, Bill Benter, to develop gambling algorithms.

Australian Capital Territory

The Australian Capital Territory has only one brick-and-mortar, the Casino Canberra. With only one casino, the ACT established a single gambling authority in March 2018 to regulate gambling activities.

- Gambling and Racing Commission – is responsible for licensing, compliance, and education.

The GRC conducts stringent evaluations to ensure gambling operators follow regulations. Apart from the casino, the regulatory body oversees the one racecourse in the territory located as well in Canberra.

Side Note

In a survey conducted in 2022, 76% of fans preferred banning gambling ads from broadcasting. Despite the opposition, the Australian Football League Fan Association was persistent with the advertisement.

With more Aussies against the ads, the issue escalated, compelling the ACT government to act and propose restrictions on sports betting advertisements.

Listed in the table are the gambling legislation enacted by the ACT government:

| GAMBLING LEGISLATION | DEFINITION |

| 1. Casino Control Act 2006 | Controls the casino operations and licensing. |

| 2. Gaming Machine Act 2004 | Regulates gaming machines in the state. |

| 3. Interactive Gambling Act 1998 | Regulates the interactive gambling activities. Amendments were made following the IGA at the federal. |

| 4. Lotteries Act 1964 | Controls the lotteries’ activities and operators. |

| 5. Pool Betting Act 1964 | Manages the pool betting activities in the state. |

| 6. Race and Sports Bookmaking Act 2001 | Regulates betting on races and other sports events. |

| 7. Racing Act 1999 | Monitors thoroughbred and harness racing. |

| 8. Totalizator Act 2014 | Provides the conduct of the totalizator and regulates its gambling form. |

| 9. Unlawful Gambling Act 2009 | Outlines the different criminal codes. |

While the ACT has nine provisions to define the policy principles, the territory has three regulations implementing the gambling legislation. These regulations are as follows:

- Casino Control Regulations 2006

- Gaming Machine Regulations 2004

- Race and Sports Bookmaking Regulations 2001

In addition, the legislation details the taxation structure. Listed below are some of the operator’s tax rates per gambling form:

Racing & Sports Betting Taxes

- Totalizator

- A 25% deduction of the total amount bet per totalizator as a commission.

- Fixed-Odd Betting

- Following the introduction of the Betting Operations Tax Act 2018, the Act revoked the Fixed Odds Sports Betting activities tax.

- Betting Exchange

- Not permitted

Gaming Machine Tax

- Clubs

- A tax rate of up to 23%, depending on the monthly gaming machine revenue.

- 0.75% for the Gambling Harm Prevention and Mitigation Fund Levy

- 0.4% contribution of the net gaming machine revenue of a club licensee.

- Hotels

- A 25.90% tax on a gross monthly gaming machine revenue.

- 0.75% for the Gambling Harm Prevention and Mitigation Fund Levy.

Casino

- General Gaming Operations: Payable of up to 10.9%.

- Commissioned-Based Operations: A tax rate of 0.9%.

Lotteries

- The state receives 76.918% of the player loss minus the GST on all NSW tickets sold in the ACT for all games.

Keno

- Has a 2.50% turnover without GST.

Other Gambling Taxes

- Trackside Simulated Racing: 2.5% of turn, exclusive of GST.

- Betting Operations Tax: 20% payable by all betting operators, which exceeds the annual threshold of AU$150,000.

Did You Know?

In May 2000, the Australian Capital Territory defied the federal government regarding the 12-month online gambling moratorium.

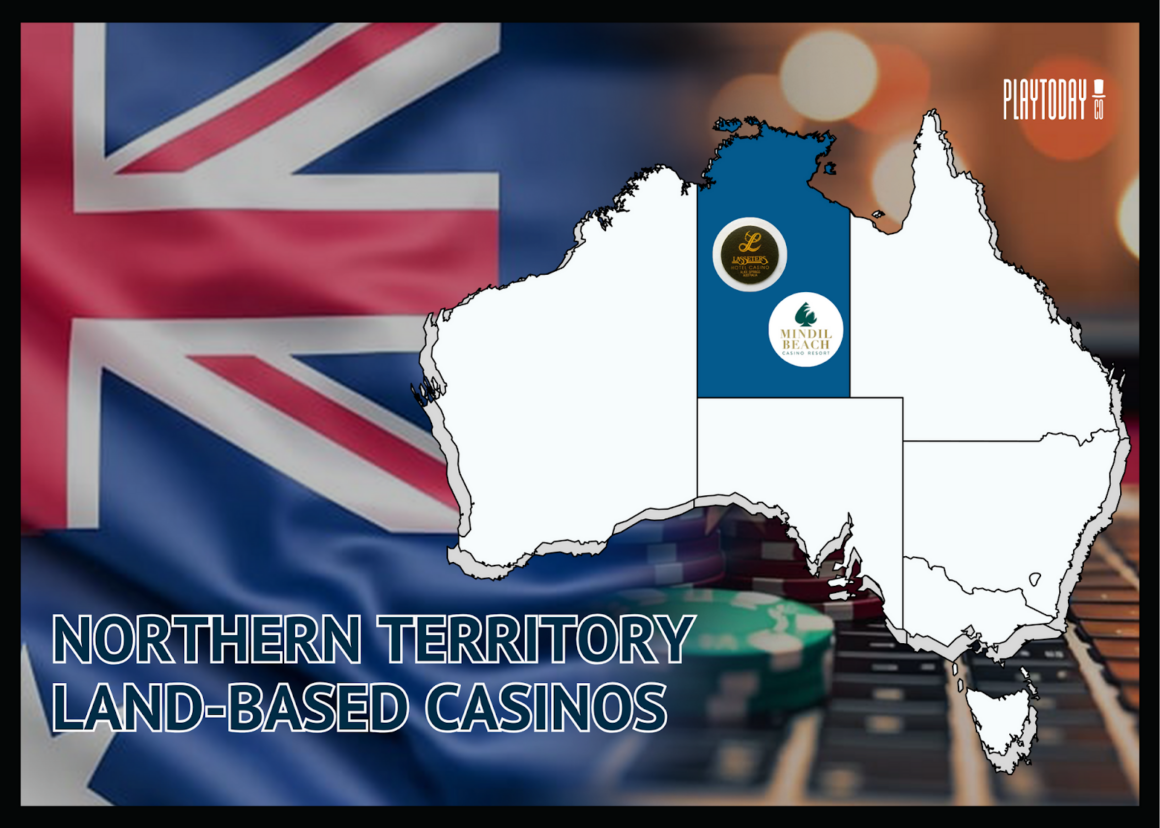

Northern Territory

The NT government has an exclusive agreement with the two current land-based casinos. The territory government can only grant another casino license with the consent of the two existing casino operators.

As of 2024, NT only has two land-based casinos:

- Mindil Beach Casino in Darwin

- Lasseters Hotel Casino Alice Springs

Two regulatory bodies ensure that the gambling industry is in order and the gambling operators are compliant:

- Department of the Industry, Tourism, and Trade – administers the legislation for the gambling industry within the state.

- NT Racing Commission – manages the racing licenses.

Refer to the table below for the list of gambling legislation in the Northern Territory:

| GAMBLING LEGISLATION | DEFINITION |

| 1. Gaming Control Act 1993 | Controls and ensures a compliant casino and gaming activity within the state. |

| 2. Gaming Machine Act 1995 | Provides regulation and control of gaming machines. |

| 3. Racing and Betting Act 1983 | Manages and controls the racing and betting activities in the state. |

| 4. Totalizator Licensing and Regulation Act 2000 | Ensures the state has regulated and licensed totalizators and wagering. |

The mentioned gambling legislations consist of regulations. These regulations are as follows:

Gaming Control Act 1993

- Gaming Control (Taxes And Levies) Regulations 2015

- Gaming Control (Reviewable Decisions) Regulations 2014

- Gaming Control (Community Gaming) Regulations 2006

- Gaming Control (Internet Gaming) Regulations 1998

- Gaming Control (Gaming Machines) Regulations 1995

- Gaming Control (Licensing) Regulations 1995

Gaming Machine Act 1995

- Gaming Machines Rules 2001

- Gaming Machine Regulations 1995

Racing and Betting Act 1983

- Unlawful Betting Act 1989

- Racing and Betting Regulations 1984

Totalizator Licensing and Regulation Act 2000

- Totalizator Licensing and Regulation (Wagering) Rules – April 2020

- Totalizator Licensing and Regulation (Wagering) Rules – July 2020

Although the legislation for interactive gambling follows the federal law of the IGA, NT has imposed codes of practice for interactive gambling. These codes aim to reduce the adverse social impact caused by gambling.

Licensed operators should formulate a strategic plan to minimize harm further. The codes of practice are as follows:

- Casino Code of Practice for Gaming Harm Minimisation 2023 – covers all licensed casino operators.

- Code of Practice for Responsible Gambling 2022 – applies to all forms of land-based gambling.

- Code of Practice for Responsible Online Gambling 2019 – applies to online gambling licenses under an act except for the Racing and Betting Act 1983.

- Code of Practice for Responsible Service of Online Gambling 2019 – governs licensed online gambling providers under the Racing and Betting Act 1983.

Side Note

Complying with the Northern Territory Code of Practice is mandatory. All licensed gambling providers – land-based and online – must adhere to the code of practice.

The NT government ensures that the state receives taxes from all legal gambling forms. Tax rates are mandated and detailed in the abovementioned gambling legislation.

Racing & Sports Betting Taxes

- Totalizator

- Race Betting: 40% of the licensee’s commission deducted less GST

- Races other than Thoroughbred, Harness Horse, & Greyhound

- 20% of the licensee’s commission deducted less GST

- Fixed-Odd Betting

- Registered (Oncourse) Bookmakers

- 0.33% of turnover, exclusive of GST

- Sports Betting

- 5% of gross profit on combined sports and racing betting, with an annual threshold of AU$1,270,000

- Registered (Oncourse) Bookmakers

- Betting Exchange

- A 5% tax rate. Tax-free with an FY threshold profit of AU$1,270,000

Gaming Machine Tax

- Clubs: Up to 49.91% tax rate, depending on the gross monthly profit

- Hotels: A Community Benefit Levy of 10% of gross profits

Casino

- Table Games: Equivalent to GST rate.

- Gaming Machines: 15% of gross profit.

Lotteries

- Fees and taxes are set by agreement between a lottery license holder and the state of the Northern Territory.

Keno

- 10% on gross profit, with an amount reduced by the GST.

Side Note

Point of consumption taxes for betting operators started in South Australia in July 2017. The same year, the federal government wanted to follow the PoC tax rate and proposed implementing it for gambling operators throughout Australia.

In 2018, other states followed in SA’s footsteps with a different PoC tax rate framework. However, the Northern Territory government opposed the PoC tax since most of the bettors on its bookmakers are residents of other states.

The State of Australia’s Gambling Industry

Gambling is prevalent in Australia, where it has become a socially accepted behavior. The industry has grown to the point where it generates billions of dollars in annual revenue for the Australian economy.

Lotteries are the most significant contributor to the gambling industry. Although there’s a decline in CAGR of 7.6% from 2019 to 2023, the lotteries industry reached a revenue of AU$20.17 billion in 2023.

Economic-wise, gambling helped the country. However, without regulations and intervention, the activity poses a negative impact on society.

Australia is experiencing a major public issue—betting addiction. Studies recognize the country as the biggest gambling loser globally, with the largest per capita loss recorded of AU$25 billion.

Side Note

Gambling addiction is considered a serious health issue in Australia. It affects all aspects of the gambler’s life–mental, physical, and social. Addiction rates have grown, with over 300,000 Australians being affected.

Gambling Forms Available in Australia

Australian gambling has a rich history that began legally in the 1800s. With a culturally linked industry, all gambling forms are legal in Australia. Two Up, Horse Racing, and the Lottery were the first three activities in the country.

Across Australia, only 14 licensed casinos exist. On the other hand, pubs and clubs are spread throughout the country, with over 7,298 operational, an increase of 3% from 2023.

Did You Know?

Regardless of the gambling forms, Australian winners are not subject to taxation. The Australian government does not consider gambling as a professional pursuit.

The table below shows the gambling forms available in the eight mainlands of Australia. Gambling form per state and territory varies.

| GAMBLING FORM | ACT | NSW | NT | QLD | SA | TAS | VIC | WA |

| Betting Exchange | 🔸 | 🔸 | 🔸 | 🔸 | 🔸 | 🔸 | 🔸 | 🔸 |

| Casino Gaming | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Gaming Machines | Hotels and Clubs only | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | Casino only |

| Keno | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | Casino only |

| Lotteries | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Football Pools | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Minor Gaming | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Online/ Interactive Gambling | 🔹 | 🔹 | 🔹 | 🔹 | 🔹 | 🔹 | 🔹 | 🔹 |

| Racing and Betting | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Sports Betting | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

🔸 Currently undertaken in Tasmania with the Tasmanian Gaming License.

🔹 Regulated by the federal government through the Interactive Gambling Act 2001.

Meanwhile, online gambling has become popular among Australian adults, with a participation rate of 17% in 2022. The industry continues to grow, with online betting as the primary contributor, reaching AU$9.09 billion in revenue in 2023.

| GAMBLING TYPE | PERCENTAGE OF AUSTRALIAN ADULTS |

| Lotteries or Scratchies | 63.8% |

| Horse Racing | 38.1% |

| Sports Betting | 33.8% |

| Poker Machines | 33.4% |

| Keno or Bingo | 29.8% |

| Greyhound Racing | 24.4% |

| Harness Racing | 22.5% |

| Casino Table Games | 22.4% |

| Novelty Betting | 17.2% |

| Online Casino Games | 17.0% |

| Other Gambling Forms | 18.5% |

The sections below describe Australia’s different gambling activity types as defined in the country’s gambling legislation.

Lottery

Australia’s highest gaming activity is the lottery, with around 64% participating in “scratchies.” The revenue has grown substantially, with annual yield rising from AU$8.1 billion in 2018 to AU$13.5 billion in 2023.

Every state and territory government used to own and operate the lotteries in the country, which started in the 1920s. However, a private sector established in 2017—Tatts Group Limited—has taken over the state-owned and operated lotteries, except for Western Australia.

The Lotterywest of WA is the only Government owned and operated lottery in Australia.

Fun Fact

Three winners shared Australia’s largest lottery prize in history, which amounted to AU$200 million in Powerball in 2022.

Keno

Keno started in NSW registered clubs in 1991. The SA Lotteries is the only lottery organization that runs the Keno games. The game is the third least-earning of the forms, making AU$500 million in 2020.

Some casinos provide outlets for Keno games, but the game mainly operates in clubs or hotels. Keno is also available online or via lottery.

Helpful Article

For Aussies and people planning to visit Australia who are interested in excelling in Keno, read about the mechanics, complexities, and tips to uncover the odds behind Keno in this link.

Gaming Tables and Machines

Australia has 14 licensed casinos, 28% of which are in Queensland. The go-to for gamblers in casinos are:

- EMGs – 13,468

- Gaming Tables – 1,884

| CASINO | LOCATION |

| The Star Gold Coast | Gold Coast, QLD |

| The Reef Hotel Casino | Cairns, QLD |

| The Ville Resort-Casino | Townsville, QLD |

| Treasury Casino | Brisbane, QLD |

| The Star | Sydney, NSW |

| Crown Sydney | Sydney, NSW |

| Country Club Tasmania | Launceston, TAS |

| Wrest Point Casino | Hobart, TAS |

| Lasseters Hotel Casino | Alice Springs, NT |

| Mindil Beach Casino Resort | Darwin, NT |

| SkyCity Adelaide | Adelaide, SA |

| Crown Melbourne | Melbourne, VIC |

| Crown Casino Perth | Perth, WA |

| Casino Canberra | Canberra, ACT |

Gaming tables and machines include pokies and blackjack. Pokies are the most popular throughout Australia, accounting for AU$95 billion in FY 2021 revenue.

| STATE/TERRITORY | CASINOS | GAMING TABLES | GAMING MACHINES |

| NSW | 2 | 483 | 1,500 |

| QLD | 4 | 276 | 3,823 |

| SA | 1 | 82 | 852 |

| TAS | 2 | 28 | 1,221 |

| VIC | 1 | 540 | 2,628 |

| WA | 1 | 350 | 2,483 |

| ACT | 1 | 49 | 0 |

| NT | 2 | 76 | 961 |

Wagering

Around 44% of Australian adults place bets on sports or racing. Whether pari-mutuel or fixed-odds betting, Australia allows betting as long as the retail or sportsbooks are licensed.

Listed below are the different kinds of betting:

- Pari-mutuel Betting

- Racing: Thoroughbred, harness, greyhound

- Other sports

Fun Fact

Sports bettors consider Australia’s Melbourne Cup as the “Horse race that stops a nation.” The even is the biggest handicap race globally, with a prize pool of AU$14 million.

- Fixed-Odds Betting

- Racing

- Virtual/Simulated Racing: only offered in retail venues, including hotels and clubs

- Sports

- Other approved events

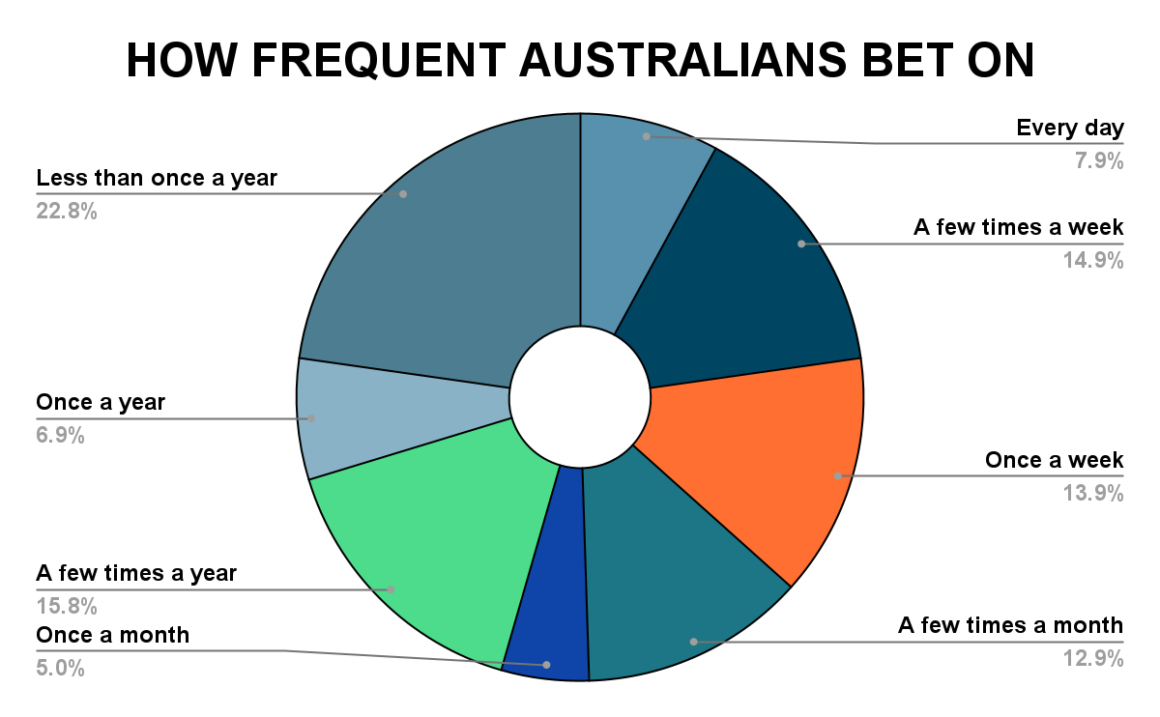

| FREQUENCY | PERCENTAGE |

| Every day | 8% |

| A few times a week | 15% |

| Once a week | 14% |

| A few times a month | 13% |

| Once a month | 5% |

| A few times a year | 16% |

| Once a year | 7% |

| Less than once a year | 23% |

Interactive (Online) Gambling

Australia was a pivotal pioneer for the history and development of online betting, launching the Centrebet to manage online sports and race betting in the Northern Territory in 1996.

Although the regulations for interactive gambling are restrictive, the participation rate has increased. Compared to 2020, the rate was only 8%. However, in 2022, over 11% of Australians have reported gambling online.

Gamblers can wager online at casinos and sportsbooks, but they must ensure that the operators are licensed.

Side Note

The federal, state, and territory governments launched the National Consumer Protection Framework for Online Wagering (National Framework).

To protect Australian gamblers, the National Framework consists of 10 measures to minimize the harm caused by online gambling. These are:

1. Prohibition of lines of credit

2. Payday lenders

3. Customer verification

4. Restrictions on inducements

5. Account closure

6. Voluntary opt-out pre-commitment scheme

7. Activity statements

8. Consistent gambling messaging

9. Staff training

10. National self-exclusion register

Fun Fact

Crash Gambling is among the casino games that Aussie gamblers should be playing in 2024. The game is a fast-paced game that sees bettors cash out before the multiplier “crashes.”Read about the top Crash Gambling platforms and games by visiting the link here.

Betting Age Restriction in Australia

Australia has a strict gambling age requirement, requiring players to be at least 18 years or older. The age restriction applies to both retail and online sports betting.

Despite the stringent legislation, kids and teens are exposed to gambling at an early age. Sports and gambling are part of Australia’s culture; every corner has signage for pubs and clubs.

Did You Know?

In August 2020, a 12-year-old girl made over 20 bets on video poker games at The Star Sydney. The girl was sneaked into the casino by her mother at the exit door to avoid security.

The mother and daughter only stayed for 17 minutes and attempted to leave, but the security detected them. Authorities penalized the casino with a AU$64,500 fine.

The AU Institute of Health and Welfare concluded that 30% of teenagers played pokies while 12% bet on sports. For that reason, the Australian government created several programs.

The following section details the programs created for the Australian minors.

Australia Awareness Program

To combat the possible illegal involvement and addiction of minors, some AU states created gambling-related programs. The programs serve to raise awareness and provide resources to educators and parents.

The target audience is primary and secondary schoolers. Out of the eight AU mainlands, only three have created gambling-related programs. Some of these are aligned with the school’s curriculum.

Here is the list of states and their programs available across Australia:

- New South Wales

- GambleAware for Teachers and Youth Workers

- Life Ready: Gambling Modules (Aligned to curriculum)

- Reclaim the Game

- Supporting Young People

- South Australia

- Gambling is No Game

- Here for the Game

- How to Support a Young Person

- Unplugged

- Tasmania

- Know Your Odds

- What’s the Real Deal? (Aligned to Curriculum)

- Victoria

- Reducing Harm: School Education Program (Aligned to curriculum)

- The Bridge

- Love the Game, Not the Odds

- Young Aboriginal People’s Gambling Awareness Program

- Video Gaming and Gambling

Did You Know?

The AU government organized the Australian Communications and Media Authority (ACMA) on July 1, 2005, to regulate gambling-related media and ads.

In 2017, the ACMA started blocking websites. Since then, 345 illegal gambling websites and 21 affiliate marketing sites are already been blocked.

Gambling Penalties in Australia

Punishments for illegal gambling involvement vary per state and territory. Whether an individual, a minor, or an operator, they will have corresponding penalties according to the offenses made.

The federal government outlines the general offenses. On the other hand, the state and territory detail the offenses and the gambling penalties.

| GAMBLING FORMS | MEN | WOMEN |

| Lotteries or scratchies | 70.2% | 58.5% |

| Horse racing | 48.4% | 58.5% |

| Sports betting | 47.5% | 21.3% |

| Poker machines | 39.9% | 27.5% |

| Keno or Bingo | 36.7% | 23.5% |

| Greyhound racing | 33.9% | 15.7% |

| Harness racing | 31.7% | 14.0% |

| Casino table games | 30.3% | 15.1% |

| Online casino games | 22.7% | 11.7% |

Side Note

Aussies view gambling as a recreational activity. Several factors must be ticked off the list to be considered as professional gamblers, where winnings are subject to taxation.

The Australian Taxation Office (ATO) interprets the gambling winnings in the Taxation Ruling IT 2655. It defines that the players can become “professional gamblers” if they meet the following criteria:

– Dedicates substantial time and money and uses methods to win;

– Ties to the gambling industry and engage in business, like horse trainers or breeders;

– Winning too regularly can be considered business as well.

Continue reading to learn about state and territory gambling offenses and penalties. Note that the penalty units used are converted to Australian dollars in the following sections.

New South Wales

The NSW Unlawful Gambling Act of 1998 defines gambling-related offenses and penalties. In NSW, the maximum penalty is up to 1,000 penalty units and seven years imprisonment. One penalty unit is equivalent to AU$110.

The table below shows the state’s gambling offenses and corresponding penalties and punishments.

| OFFENSE | MAXIMUM PENALTY | IMPRISONMENT | COMBINATION | |

| Unlawful gambling operation | AU$110,000 | 7 years | ✔️ | |

| Unlawful betting offenses | AU$550 | 1 year | ✔️ | |

| Unlawful bookmaking offenses | – First Offense: AU$1,100- Second Offense: AU$5,500 | 2 years | ✔️ | |

| Unlawful organizing, conducting, or profiteering gambling | – First Offense: AU$550- Second Offense: AU$1,100 | – First Offense: 1 year- Second Offense: 2 years | ✔️ | |

| Selling a ticket | AU$550 | 1 year | ✔️ | |

| Participating or betting | AU$550 | 1 year | ✔️ | |

| Minors engaging in any form with a minor or on behalf of a minor | AU$550 | ❌ | ❌ | |

| Minors participating in any forms | AU$220 | ❌ | ❌ | |

| Cheating at gambling | AU$1,100 | 2 years | ✔️ | |

Queensland

Queensland uses a penalty unit for any gambling offenses. One penalty unit is equivalent to AU$154.8. The maximum penalty the state government can give is AU$92,880 with a maximum imprisonment of 3 years.

Most offenses don’t penalize and punish the perpetrator. Illegal advertisement is the only offense that charges the offender with penalty and imprisonment.

Did You Know?

Star Entertainment QLD Limited was found guilty of eleven offenses in operating its Brisbane and Gold Coast casinos. The Office of Liquor and Gaming Regulation (OLGR) penalized The Star for AU$140,000.

The table below details the gambling offenses and penalties.

| OFFENSE | MAXIMUM PENALTY | IMPRISONMENT | COMBINATION |

| Advertisement breaches | AU$30,960 | ❌ | ❌ |

| Bringing or keeping a machine at a licensed venue other than the ones required. | AU$38,700 | ❌ | ❌ |

| A licensee allows the licensed premises to be used for betting | AU$15,480 | 6 months | ❌ |

| Unlawful hosting | AU$92,880 | 3 years | ❌ |

| Unlawful conducting | AU$30,960 (200 penalty units) | ❌ | ❌ |

| Unlawful playing | AU$6,192 (40 penalty units) | ❌ | ❌ |

| Minor playing in a casino | AU$3,870 (25 penalty units)- Wins: The minor will leave empty-handed or anyone else on the minor’s behalf.- Loses: Wagers cannot be recovered by the minor or anyone else on the minor’s behalf. | ❌ | ❌ |

| Casino operators allowing minors to play | AU$15,480 (100 penalty units) | ❌ | ❌ |

| An agent or staff of a casino operator allowing minors to play | AU$6,192 (40 penalty units) | ❌ | ❌ |

| Adult aiding or allowing a minor to enter a casino | AU$3,096 (20 penalty units) | ❌ | ❌ |

| Unauthorized gambling, including advertising and providing a place. | AU$19,231 (100 penalty units) | 2 years | ✔️ |

Definition

South Australia

The SA Government enacted the Gaming Offences Act 1936. The law specifies the list of unlawful gambling and their equivalent penalties and imprisonments.

Out of the listed illegal gambling activities, cheating will charge the perpetrator a fine and a 2-year jail time. However, a fake bookmaker will receive a maximum charge of AU$50,000 and four years imprisonment.

Refer to the table below for the gambling offenses, penalties, and imprisonment.

| OFFENSE | MAXIMUM PENALTY | IMPRISONMENT | COMBINATION |

| Cheating in gambling | AU$10,000 | 2 years | ✔️ |

| Extending provision to gaming with coin | AU$1,250 | ❌ | ❌ |

| Gambling in public places | AU$10,000 | 2 years | ❌ |

| Bets with a minor | AU$2,500 | ❌ | ❌ |

| A minor makes a bet | AU$2,500 | ❌ | ❌ |

| Soliciting totalizator investments | AU$5,000 | ❌ | ❌ |

| Unauthorized conducts of a totalizator betting | AU$20,000 | 1 year | ❌ |

| A person who makes a bet to an illegal totalizator | AU$5,000 | 6 months | ❌ |

| Unlawful gaming and playing of unlawful games | AU$2,500 | ❌ | ❌ |

| Being in public for unlawful betting | AU$5,000 | 1 year | ❌ |

| Acting as a bookmaker | AU$50,000 | 4 years | ❌ |

| A person who makes a bet to an illegal bookmaker | AU$5,000 | 1 year | ❌ |

| Unauthorized conduct of a betting exchange | AU$20,000 | 1 year | ❌ |

| An unauthorized person who makes a bet on an illegal betting exchange | AU$5,000 | 6 months | ❌ |

| Betting notices and placards | AU$2,500 | ❌ | ❌ |

Did You Know?

In June 2023, South Australia saw its first ever case of Live Baiting crimes when authorities caught Troy, Connor, and Jackson Murray conducting illegal activities.

Authorities charged the three with life bans and a total fine of AU$180,000, the largest penalties applied in SA in history.

Live baiting refers to the illegal act of using small animals to excite and enhance a chase instinct in young greyhounds.

Tasmania

The Tasmanian Government has only passed one gambling legislation, the Gambling Control Act 1993, which covers the lawful and lawful gambling activities.

The state charges the most to an individual who alters any gaming equipment: a fine of AU$195,000 and four years of imprisonment. TAS uses penalty units to dictate the fines for the offender. One penalty unit is equivalent to AU$195.

Refer to the table below for the offenses and their corresponding penalties.

| OFFENSE | MAXIMUM PENALTY | IMPRISONMENT | COMBINATION |

| A gaming operator permits an unlawful game of keno | AU$19,500 | ❌ | ❌ |

| A venue or gaming operator permits withdrawn gaming equipment to be used. | AU$195,000 | ❌ | ❌ |

| The use of unprotected gaming machines | AU$78,000 | 2 years | ✔️ |

| Unlawful interference with the gaming equipment | AU$195,000 | 4 years | ✔️ |

| Make a loan or pay in cheque | AU$19,500 | ❌ | ❌ |

| Excluded persons entered a casino | AU$3,900 | ❌ | ❌ |

| A casino with no list of excluded persons | AU$9,750 | ❌ | ❌ |

| Minors enter restricted areas | AU$1,950 | ❌ | ❌ |

| Minors participate in gambling | AU$3,900 | ❌ | ❌ |

Did You Know?

In 1973, Tasmania established the nation’s first legal casino at Federal Hotels’ Wrest Point in Hobart.

Victoria

Victoria enacted the Gambling Regulation Act 2003, which outlines and defines gambling-related offenses. VIC follows the penalty unit system, where one unit equals AU$192.31.

Gambling offenders can be penalized for up to AU$192,310 with a maximum of 2 years of imprisonment. One violation that has the maximum penalty and imprisonment is advertising illegal gambling.

The fines and penalties for gambling-related offenses in Victoria are listed in the table.

| OFFENSE | MAXIMUM PENALTY | IMPRISONMENT | COMBINATION |

| Unauthorized gambling | AU$192,310 | 2 years | ✔️ |

| Advertisement of unauthorized gambling | AU$192,310 | 2 years | ✔️ |

| Providing a place for unauthorized gambling | AU$192,310 | 2 years | ✔️ |

| A person found in unauthorized gambling | – First offense: AU$4,808– Second offense: AU$11,539 | ❌ | ❌ |

| Modification of gaming machine areas | AU$19,231 | ❌ | ❌ |

| Illegal possession, supplying, selling, or obtaining of gaming machines | AU$192,310 | 2 years | ✔️ |

| A venue operator allowing the gaming of unprotected devices | AU$76,924 | 2 years | ✔️ |

| Cheating in gambling | AU$76,924 | 2 years | ✔️ |

| Makes a loan to play a gaming machine in an approved venue. | AU$19,231 | ❌ | ❌ |

| Cashing of cheques to extend the gameplay | AU$11,539 | ❌ | ❌ |

| Publishing gaming machine advertisement | AU$23,078 | ❌ | ❌ |

| Offense relating to totalizator | AU$11,539 | ❌ | ❌ |

| Unauthorized public lottery and keno | AU$19,231 | ❌ | ❌ |

| Use of defective gaming equipment | AU$19,231 | ❌ | ❌ |

| Unlawful community and charitable gaming | AU$11,539 | ❌ | ❌ |

| A gambling provider allows a minor to gamble. | AU$23,078 | ❌ | ❌ |

| A gambling employee/bookmaker allows a minor to gamble. | AU$3,847 | ❌ | ❌ |

| A registered bookmaker (a corporate) allows a minor to gamble. | AU$23,078 | ❌ | ❌ |

| Assist a minor to gamble | AU$1,924 | ❌ | ❌ |

| A minor participates in gambling or enters a casino. | AU$1,924 | ❌ | ❌ |

| If a minor enters an approved venue’s casino or gaming machine area, the venue operator is guilty of an offense. | AU$23,078 | ❌ | ❌ |

| A minor faking an ID | AU$1,924 | ❌ | ❌ |

Did You Know?

Tabcorp’s Wagering and Betting System (WBS) faced a record fine of AU$1 million in November 2020. During the Spring Racing Carnival, the service was unavailable for around 36 hours due to a major system outage.

The Wagering and Betting License and Agreement states that the WBS must be continuously available, which resulted in the VGCCC investigating the incident.

Further investigation led VGCCC to conclude that Tabcorp failed to comply with the necessary report. Tabcorp submitted a compliance report four months after the deadline.

Western Australia

Western Australia uses a penalty unit, where 1 unit equals AU$50. WA has the lowest AUD equivalent per penalty unit compared to the other states and territories.

Among the offenses listed in the Gaming and Wagering Commission Act 1987 (GWCA), only three of the crimes will charge imprisonment to the offenders:

- Cheating a gameplay

- Altering a ticket

- Possessing an illegal machine

The rest of the offenses penalize perpetrators around AU$100 to AU$20,000. Even though the GWCA did not contain the set of violations, the Act still fines offenders AU$1,000.

The table below shows the penalties for gambling-related offenses in Western Australia.

| OFFENSE | MAXIMUM PENALTY | IMPRISONMENT | COMBINATION | |

| An offense breaching the Gaming and Wagering Commission Act 1987 with no penalty specifically provided | AU$1,000 | ❌ | ❌ | |

| A person who participates in an unlawful game | AU$500 | ❌ | ❌ | |

| Unauthorized broadcasting, printing, or publishing | AU$5,000 | ❌ | ❌ | |

| Cheating in gambling | AU$10,000 | 2 years | ✔️ | |

| Altering any material such as tickets or coupon | AU$5,000 | 1 year | ✔️ | |

| Unauthorized lottery | AU$2,500 | ❌ | ❌ | |

| Illegal possession of a gaming machine | AU$5,000 | 1 year | ✔️ | |

| Use of unlawful cash or tokens in gaming machines | AU$100 | ❌ | ❌ | |

| Illegal selling and supplying of gaming equipment | AU$5,000 | ❌ | ❌ | |

| A person who places or uses a remote gambling device in public | AU$20,000 | ❌ | ❌ | |

Australian Capital Territory

The Government of ACT uses a penalty unit to reprimand gambling offenders. The state imposes two different penalty units:

- Individual penalty unit = AU$150

- Corporation penalty unit = AU$750

Most offenses penalize and imprison the wrongdoers. Cheating in gambling has the highest fine and imprisonment among the listed crimes with a maximum penalty of up to AU$30,000 and a 2-year imprisonment.

Below is the list of offenses, penalties, and imprisonment for individual and corporate offenders.

| OFFENSE | MAXIMUM PENALTY | IMPRISONMENT | COMBINATION |

| Cheating in gambling | AU$30,000 | 2 years | ✔️ |

| Unlawful arranging and conducting of gambling or betting | AU$15,000 | 1 year | ✔️ |

| Unlawful conducting of gambling or betting with under 18 years old participants | AU$30,000 | 1 year | ✔️ |

| Owning a place with unlawful gambling or betting | AU$15,000 | 1 year | ✔️ |

| Participating in unlawful gambling or betting | AU$7,500 | ❌ | ❌ |

| Unlawful receiving of proceeds | AU$15,000 | 1 year | ✔️ |

| Advertising unlawful gambling or the place it occurred in | AU$7,500 | ❌ | ❌ |

| Inviting a child to bet | AU$7,500 | ❌ | ❌ |

| Illegal possession of gambling equipment | AU$15,000 | 1 year | ✔️ |

Side Note

Any incident involving gambling services must be resolved first with management staff. If there’s no action, the person can raise the complaint to the Gambling and Racing Commission.

The GRC shall investigate reports related to any of the following:

– Gaming Machines

– Casino Canberra

– ACTTAB Wagering

– ACT Licensed Bookmakers

– Bingo

– Lotteries and Raffles

– Keno

Northern Territory

Since 2009, the Northern Territory Government has used penalty units to work out each fine. One penalty unit is worth AU$176 between July 1, 2023 and June 30, 2024.

The value of penalty points changes every July 1, with a year-over-year average increase of 2.2%.

All gambling offenses related to individual illegal participation (possession of gaming equipment) will have a fine of 85 penalty units or 2-year imprisonment. Corporations involved in any illegal activities will receive the same fines and imprisonment.

Below are the listed gambling offenses and their penalties and years of imprisonment.

| OFFENSE | MAXIMUM PENALTY | IMPRISONMENT | COMBINATION | |

| Unlawful playing or organizing a game | AU$14,960 | 2 years | ❌ | |

| When a licensee has a minor in the area who operates or plays any gambling activities | AU$14,960 | 2 years | ❌ | |

| Unauthorized distribution or reprinting of ticket | AU$14,960 | 2 years | ❌ | |

| Unauthorized possession or supply of gaming machine | AU$14,960 | 2 years | ❌ | |

| Advertising an unlawful game or illegal lottery | AU$14,960 | 2 years | ❌ | |

| Illegal venue or host | AU$14,960 | 2 years | ❌ | |

| Cheating in gambling | AU$14,960 | 2 years | ❌ | |

| Offenses against the Regulations | AU$2,992 | ❌ | ❌ | |

Did You Know?

In February 2023, the NT Racing Commission penalized the sports betting operator Ladbrokes for AU$80,000. Ladbrokes failed to check the source of money and offered bonuses worth AU$528,890 to Gavin Fineff.

Gavin Fineff, a financial advisor, had extensive bets and misappropriated over AU$8 million. A significant portion of the money belonged to his clients and friends.

Bottomline

Australia has a strong interest in gambling. It has been part of the country’s culture that has become increasingly common, even among school-age children.

The government recognized gambling’s potential financial gain. Gambling has become a norm, and bettors have a more comprehensive range of legal gambling options.

As a result, the Australian states and territories have enacted numerous stringent legislation and regulations to ensure economic gain while protecting the people.

FAQ

Do gamblers pay tax in Australia?

Gambling winnings are tax-free. However, if a gambler wins regularly and is associated with the gambling business, the winnings are subject to taxation.

What happens if a foreigner wins the lottery in Australia?

Taxation applies to non-Australian residents and varies depending on their countries’ tax rates.

What happens if an Australian minor is seen gambling?

The minor will be penalized depending on the level of illegal activity. Any operators and guardians who allow the minor to gamble will have a higher penalty.

BC.Game

BC.Game  7Bit

7Bit  Ducky Luck

Ducky Luck  Red Dog

Red Dog