The Facts and Figures Behind Gambling Taxes by US States in 2024

Legal Disclaimer

This article is for informational purposes only and does not offer legal advice. Contact your attorney to secure advice on any issue or problem.

Using this article or any links doesn’t create an attorney-client relationship. The writer’s views do not reflect the opinions of the firm or any individual attorney.

The US allows sports betting and casino games in most states. Although the legalization is under federal law, each US state is responsible for regulating its gambling industry and taxing its bettors.

The federal government has collected a tax rate of 24%, while each state has its tax rate. Since the legalization of sports wagers in 2019, the country has accumulated over $187.04 billion in revenue.

Discover each state’s tax rates and revenues and how big their contribution is in terms of revenue.

Highlights of the Article

- Gambling winnings are considered income and are subject to taxation.

- Of the 50 US states, 39 have legalized sports betting as of 2024.

- Montana offers a $50 license fee for three years, beating Nevada’s $500.

- New Jersey is the country’s sports betting capital, accounting for over $3.37 billion in all-time revenue.

- Tennessee has imposed a 1.85% handle tax, replacing the previous 20% tax on sports betting.

- New Hampshire, New York, and Rhode Island have the highest sports betting tax rates, imposing 51%.

- Promotional bets are included in the Gross Gaming Revenue.

- US states can deduct gambling losses from the payouts, provided that they are recorded and itemized.

- Operators will withhold payouts for the 24% federal tax.

How Much the US Taxes Its States for Gambling

The US government deems gambling winnings as INCOME AND TAXABLE. The federal government takes 24% of the payout, with varying tax rates depending on the state.

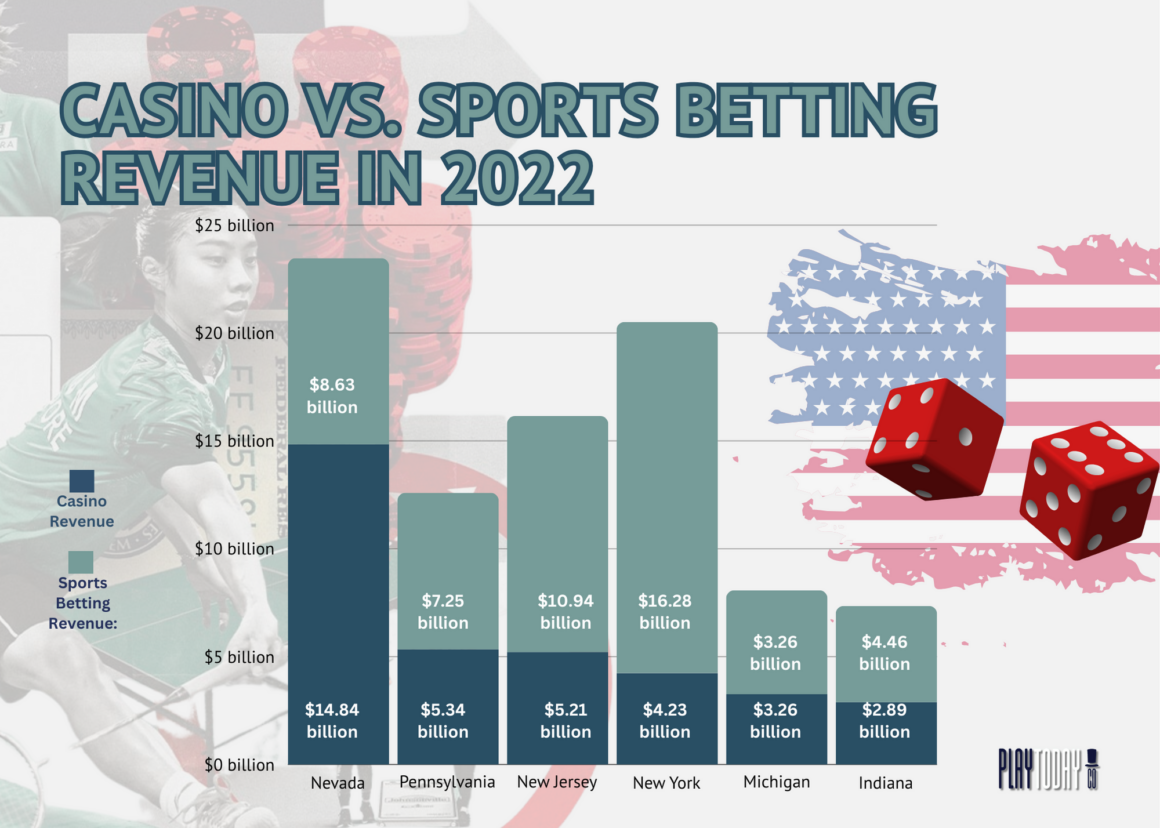

With the two-level taxation, the US is among the most significant gambling markets worldwide, with $60.42 billion in revenue in 2022, primarily contributed by casino slots and table games.

Meanwhile, sports bets flourished during the pandemic. Online sports betting has now emerged in the majority of states. In 2023, the industry reached almost $25 billion in revenue.

Keep reading to delve deeper into each state’s tax and revenue contributing to the United States gambling industry. Here, you will learn more about the sports betting sector per state.

The United States Sports Betting Tax Design in 2024

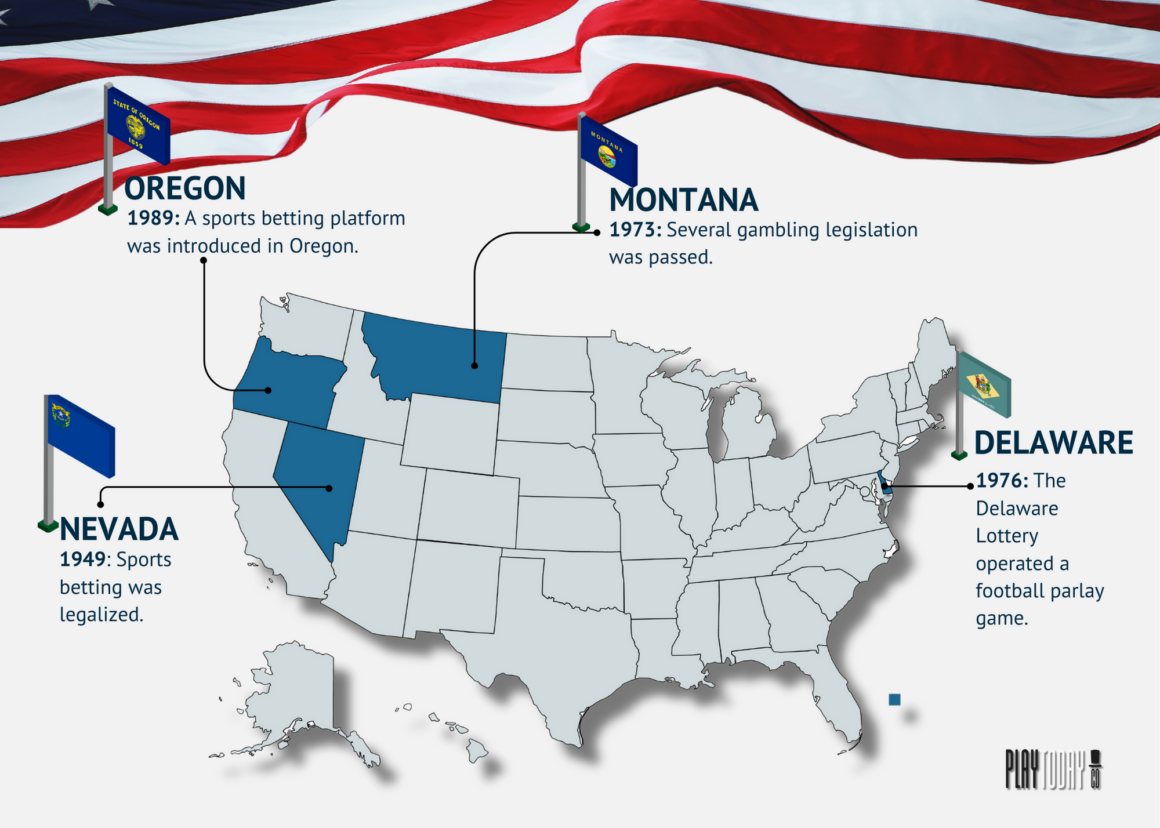

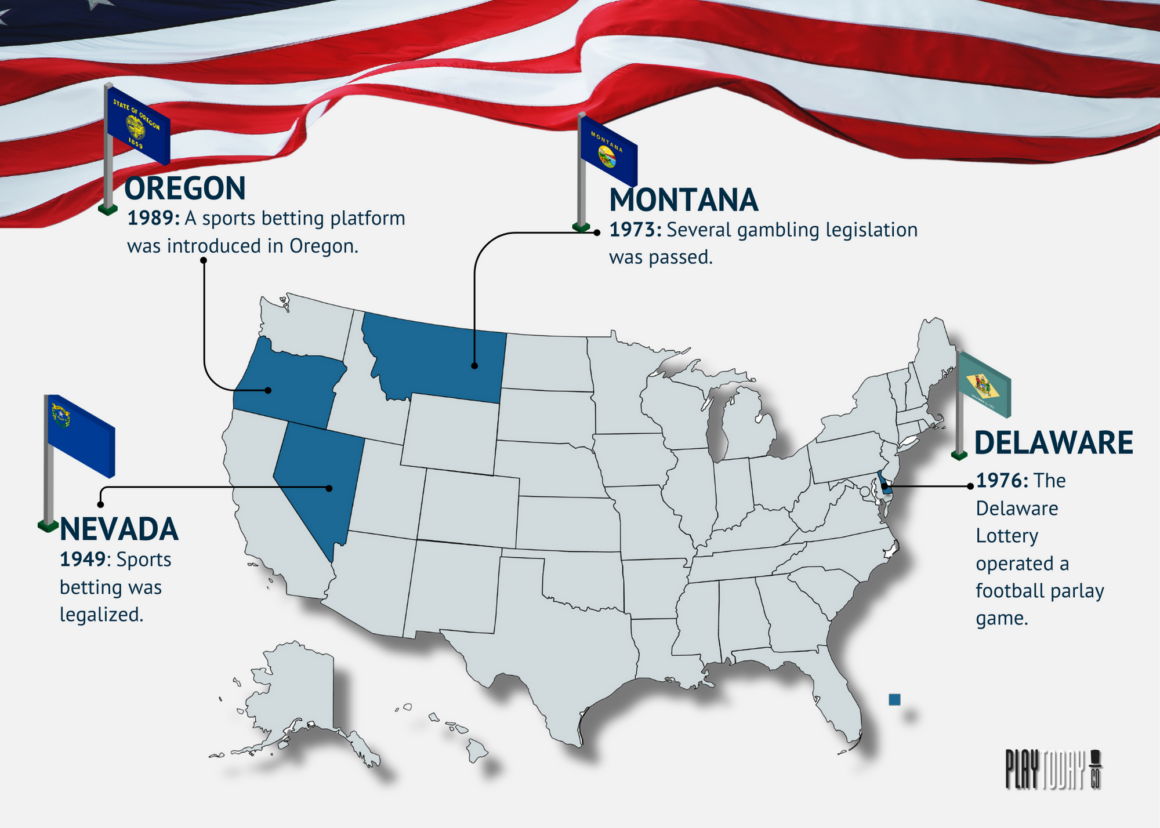

Before the US overturned the Professional and Amateur Sports Protection Act (PASPA) in 2018, only 4 US states held sports bets legally based on technicalities: Nevada, Oregon, Montana, and Delaware.

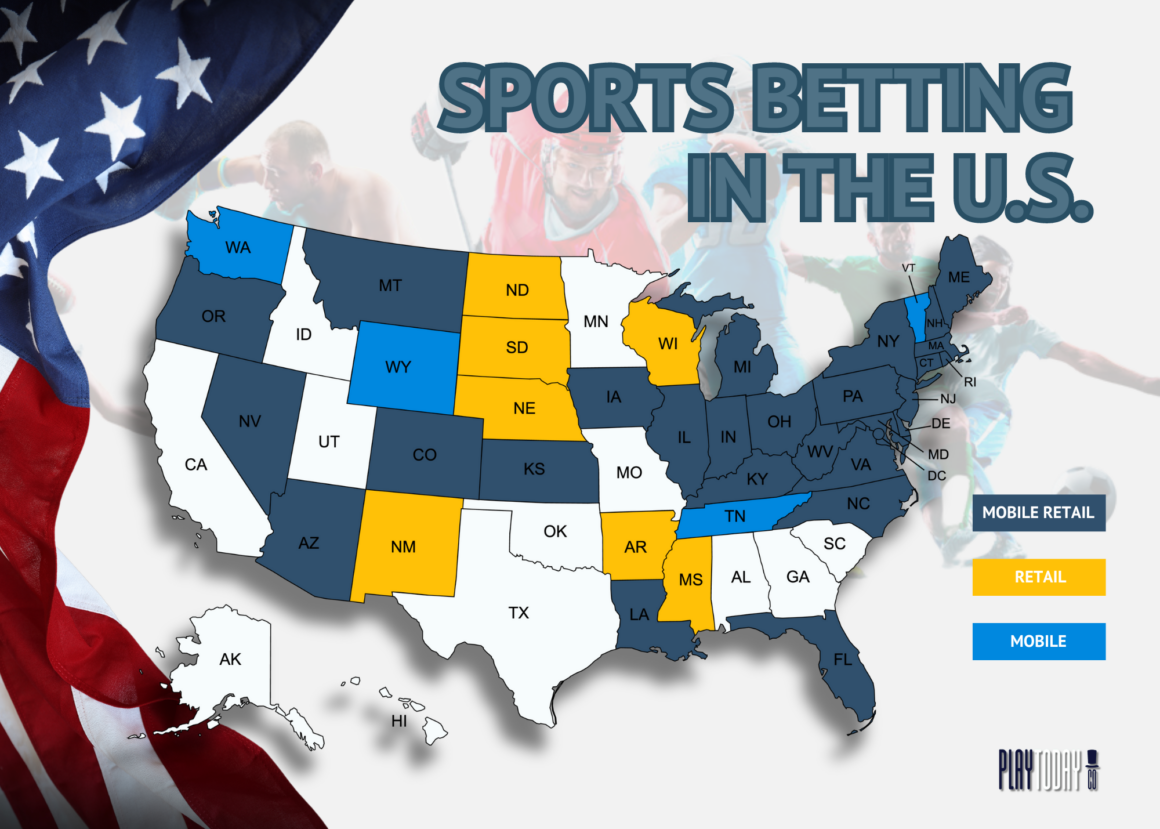

Since the repeal, more states have legalized sports betting, increasing from 8 in 2018 to 39 as of February 2024. This Act has resulted in revenue growth and increased taxation for the states.

Among the 39 states that allow sports betting, only 29 permit online sports betting. Tax rates in online and retail sportsbooks differ in the following states:

- Arizona

- Arkansas

- Connecticut

- Florida

- Kentucky

- Louisiana

- Maine

- Massachusetts

- Michigan

- New Hampshire

- New Jersey

- New York

- Virginia

The lowest tax is around 6%, while the highest is 51%. At the federal level, regardless of what state or sportsbook type the winnings come from, the tax rate is fixed at 24%.

Each state follows a Gross Gaming Revenue to target sports betting operators’ gross receipts. The GGR includes the promotional bets offered by the operators.

Operators use effective tax rates as a profitability metric. Due to the taxation of GGR, it created unjustifiable effective tax rates that could go over 60%.

To fully understand the effect of taxable GGR, let’s calculate a state effective tax rate.

Scenario

- Suppose the state of 51% tax rate has a GGR of $113 million, and the handle is $1.62 billion (a 7% hold):

- Calculate first the federal gambling tax: Handle x 0.25%

- $1.62 billion x 0.25% = $4.05 million

- For the state tax: GGR x 51%

- $113 million x 51% = $57.63 million

- Total tax: Federal Tax + State Tax

- $4.05 million + $57.63 million = $61.68 million

- Actual Revenue: GGR excluding the promo bets, assuming that 25% of the GGR is made up of promotional offers.

- $113 million x 75% = $84.75 million

Given the assumption and calculation, the operator pays high taxes. The effective rate is higher than it should be, amounting to over 73%.

Side Note

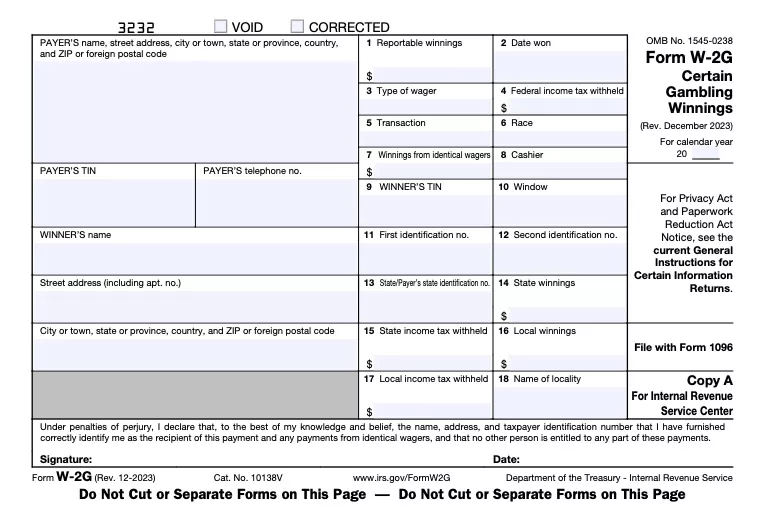

When a gambler wins a certain amount, the casino or gambling hub will email the bettor a W-2 G form for the taxes.

Suppose no tax is withheld and no W-2 G form is received. In that case, the winning bettor is responsible for filing and reporting all their gambling income at the state and federal levels.

Let’s explore the comprehensive list of states with a legalized sports betting market and their tax design.

Arizona

The Grand Canyon legalized sports betting in April 2021. In the same year, Arizona officially opened the market on September 9. The state acquired over $32.31 million in revenue in its first month.

Bettors in Arizona must be 21 years old and older to wager legally. However, players, coaches, and referees cannot bet on their sport.

Arizona has 15 betting sites, giving the bettors different options. In 2022, the state’s total handle grew to $6.03 billion.

| Online Tax | 10% |

| Retail Tax | 8% |

| Effective Tax | 3.6% |

| License Fee | $750,000 |

| Model | Multiple, mobile, and retail |

| State Regulator | Arizona Department of Gaming |

Fun Fact

In February 2023, Super Bowl LVII occurred at the State Farm Stadium. It was the first event held in Arizona with legalized sports wagering.

Arkansas

The Natural State legislated sports wagers in July 2019 but only approved online and mobile sports betting in February 2022. After a month, The Natural State launched its online sportsbooks.

There are eight sportsbooks in Arkansas. Compared to other states’ sports betting laws, AR is more lenient. In 2023, the sports betting revenue significantly increased by 106.4% compared to last year, accounting for over $37.15 million.

| Online Tax | 13% |

| Retail Tax | 13% of $150 million, then 20% |

| Effective Tax | 14% |

| License Fee | Up to $250,000 |

| Model | Multiple and Retail |

| State Regulator | The Arkansas Racing Commission |

Colorado

The Centennial State’s sports betting market launched in November 2019. Six months later, CO sportsbooks officially launched and went live.

Online sportsbooks must partner with one of the state’s casinos to operate legally, leaving more doors for online apps. With 20 online sportsbooks, the state was among the first to record a monthly handle of over $200 million in September 2020.

| Online Tax | 10% |

| Retail Tax | 10% |

| Effective Tax | 4.5% |

| License Fee | $73,000 online, $12,300 retail |

| Model | Multiple, mobile, and retail |

| State Regulator | Colorado Division of Gaming |

Did You Know?

Proxy wagering is illegal in Colorado. On June 20, 2022, Monarch Casino was fined $400,000 for multiple Colorado sports betting law violations.

The company self-reported the incident, involving three of its employees who placed bets on behalf of customers.

Connecticut

The Nutmeg State launched its retail and online sports betting in 2021. The state is among the smallest by land area in the US but is one of the most prominent online gambling markets, housing three online sportsbooks:

- Fanatics

- DraftKings

- FanDuel

Connecticut also has two brick-and-mortar casinos and 16 available retail sportsbooks, with the latter generating an average monthly handle of over $200 million.

| Online Tax | 18% |

| Retail Tax | 13.75% |

| Effective Tax | 10.5% |

| License Fee | $250,000 |

| Model | Multiple, mobile, and retail |

Delaware

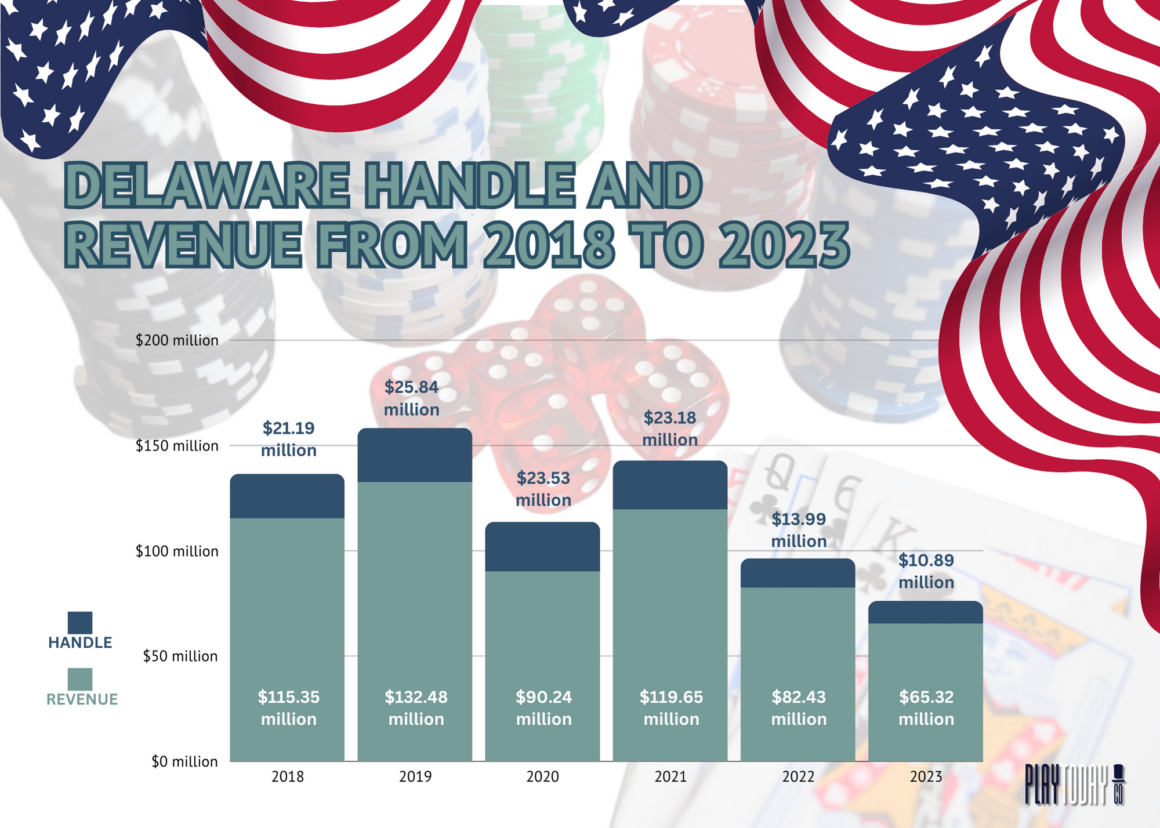

Delaware was the first US state to allow sports betting after the Supreme Court repealed the PASPA in 2018. Despite the prompt action, the Diamond State only allowed online sports betting in December 2023.

The state has 1 active betting site and 3 available retail sportsbooks. Despite limited options, DE had a total handle of $605.49 million. With a tax rate of 50%, the state acquired a GGR of $118.64 million.

| Online Tax | 50% |

| Retail Tax | 50% |

| Effective Tax | 51.4% |

| Model | Lottery Monopoly |

| State Regulator | The Delaware Lottery |

Fun Fact

Technically, Delaware is the second state—next to Nevada—to allow sports bets. However, DE was the first US state to allow sports wagers after the PASPA overturn, thus earning the nickname “The First State.”

Florida

Florida’s sports betting market legally opened in November 2021. The state allows six sportsbooks to operate, but only one was approved to launch in the market: the Hard Rock Bet.

Hard Rock Bet, formerly Hard Rock Sportsbook, only ran for a month. After two years of unsuccessful relaunch attempts, Florida reopened its sports betting market on November 7, 2023.

As of February 2024, Hard Rock Bet is still the only betting site and app allowed in the state.

| Retail Tax | 13.75% |

| Effective Tax | 12.5% |

| License Fee | $500 million |

| Model | Tribal |

| State Regulator | Florida Gaming Control Commission |

Did You Know?

Atlanta Falcons receiver Calvin Ridley was suspended for the entire 2022 NFL season when reports revealed that Ridley placed a bet on NFL games in 2021 via Hard Rock Sportsbook.

Illinois

On March 5, 2022, Illinois ended in-person registration. Bettors no longer have to visit brick-and-mortar casinos to sign up for sports betting.

Bettors have multiple options to wage with the state’s eight betting apps. Also, IL has three racetracks, namely:

- Arlington International Racecourse

- FanDuel Sportsbook and Horse Racing

- Hawthorne Race Course

In October 2022, IL became the fourth state to achieve a $1 billion monthly handle. Since then, the state’s sports betting market has flourished, hitting over a billion in monthly handles.

| Online Tax | 15% |

| Retail Tax | 15% |

| Effective Tax | 15% |

| License Fee | – Initial: $20 million- Renewal: $1 million |

| Model | Multiple, mobile, and retail |

| State Regulator | The Illinois Gaming Board |

Indiana

On September 1, 2019, the Hoosier State opened its sports betting market legally. Since then, there have been 12 legal online sportsbooks in the state.

Unlike other states, Indiana prohibits eSports betting but allows college sports betting. Even with the restriction, the state accumulated a total handle in 2022 of more than $4.44 billion.

| Online Tax | 9.5% |

| Retail Tax | 9.5% |

| Effective Tax | 9.5% |

| License Fee | $100,000 |

| Model | Multiple, mobile, and retail |

| State Regulator | Indiana Gaming Commission |

Did You Know?

In June 2023, the NFL launched an investigation into Colts’ cornerback Isaiah Rodgers upon reports of allegedly opening a sportsbook account and betting around one hundred times, including on his team.

The investigation resulted in Rodgers and several NFL players receiving suspensions for the entire NFL 2023 season for violating league policy. This incident also led to Rodgers getting cut from the team.

Iowa

The Hawkeye State’s retail and online sportsbooks launched three months after ratifying its sports betting. William Hill and Elite Sportsbook were the first betting sites to go live, debuting on August 15, 2019.

Iowa has had 19 active sports betting operators. In January 2021, the sports betting market significantly grew after removing in-person registrations, hitting over $2 billion in annual sports bets.

| Online Tax | 6.75% |

| Retail Tax | 6.75% |

| Effective Tax | 7.3% |

| License Fee | – Initial: $45,000- Renewal: $10,000 |

| Model | Multiple, mobile, and retail |

| State Regulator | Iowa Racing and Gaming Commission |

Did You Know?

Under Iowa Law SF617, gambling providers must submit 0.75% of their GGR for charitable causes.

Kansas

The Sunflower State approved sports wagers on May 11, 2022. Land-based and online sportsbooks launched in less than three months, accounting for $22.01 million in gross revenue.

Kansas has four commercial casinos. Each can host up to three online skins, allowing 12 mobile operators in the state.

Definition

Kansas’ six sportsbooks went live simultaneously. The government approved all six sports betting platforms to launch and start their operations in September 2022. These are:

- Barstool

- BetMGM

- Caesars

- DraftKings

- FanDuel

- PointBet

| Online Tax | 10% |

| Retail Tax | 10% |

| Effective Tax | 3.1% to 5.7% |

| License Fee | $45,000 |

| Model | Multiple, mobile, and retail |

| State Regulatory | Kansas Racing and Gaming Commission |

Kentucky

In March 2023, the KY administration passed House Bill 551, allowing the state’s nine racetracks to partner with up to three mobile sportsbooks. Potentially, the state can have 27 online betting options.

The Bluegrass State released its gambling provisions four months after the legalization, imposing the minimum age requirement of 18 to 21 for sports betting, depending on the operator.

Here’s the breakdown of operators with an age requirement of at least 21 years old:

- BetMGM

- FanDuel

- Caesars

- Fanatics

The four sports betting platforms above are prominent for offering generous rewards to their customers, especially abundant welcome bonuses for newly registered accounts.

| Online Tax | 14.25% |

| Retail Tax | 9.75% |

| License Fee | – Racetracks: $500,000- Online: $50,000 |

| Model | Mobile and retail |

| State Regulator | Kentucky Horse Racing Commission |

Fun Fact

Roughly one month since Kentucky sports betting launch, gamblers have wagered over $250 million. Additionally, the scene has created around 500,000 mobile betting accounts.

Louisiana

Louisiana allows up to 41 sports betting sites and 20 land-based sportsbooks. As of January 2024, the state has 9 online and 12 retail sportsbooks, with a tax rate of 5% for gambling winnings.

In November 2022, the Pelican State had a handle of $268.64 million. Due to the significant winnings from baseball World Series bets, the state had a revenue loss of $25.31 million.

Despite the revenue loss, the sports betting market in the state still had promising figures:

- 2022: $215,680,964

- 2023: $303,117,468

| Online Tax | 15% |

| Retail Tax | 10% |

| Effective Tax | 10% |

| License Fee | $750,000 |

| Model | Multiple, mobile, and retail |

| State Regulator | Louisiana Gaming Control Board |

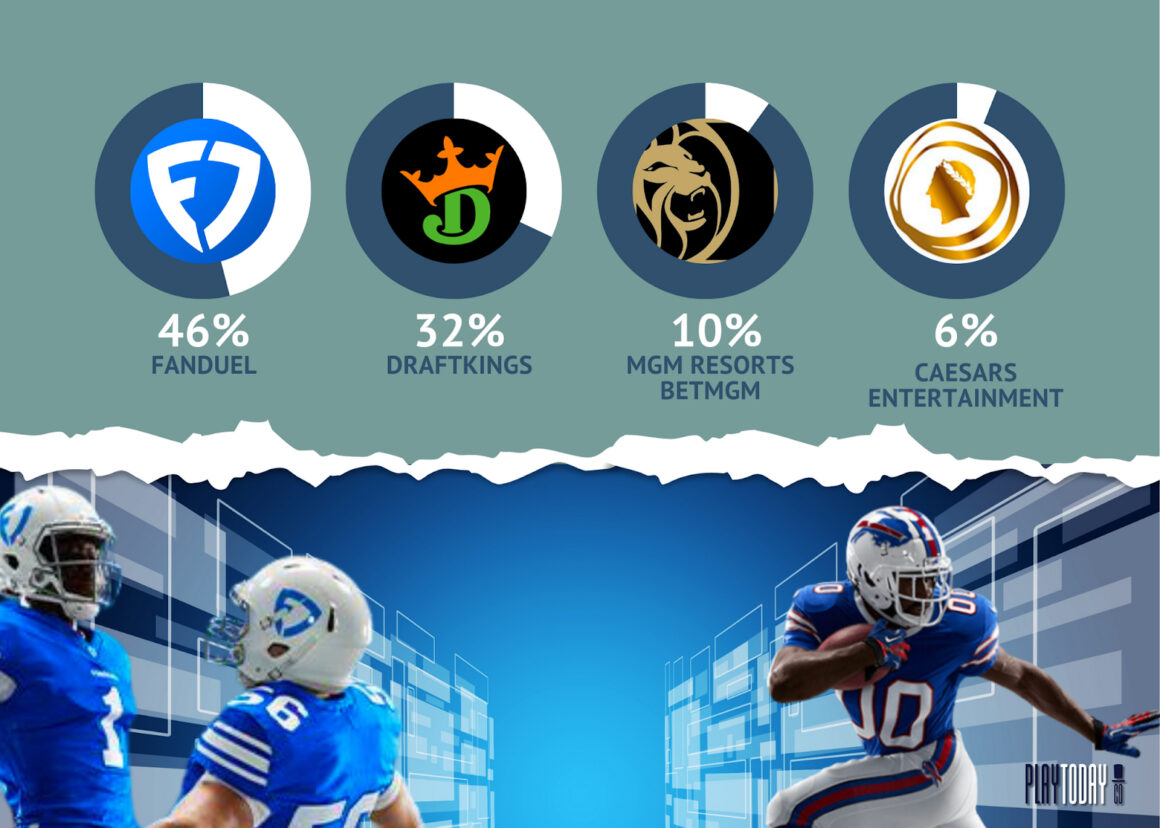

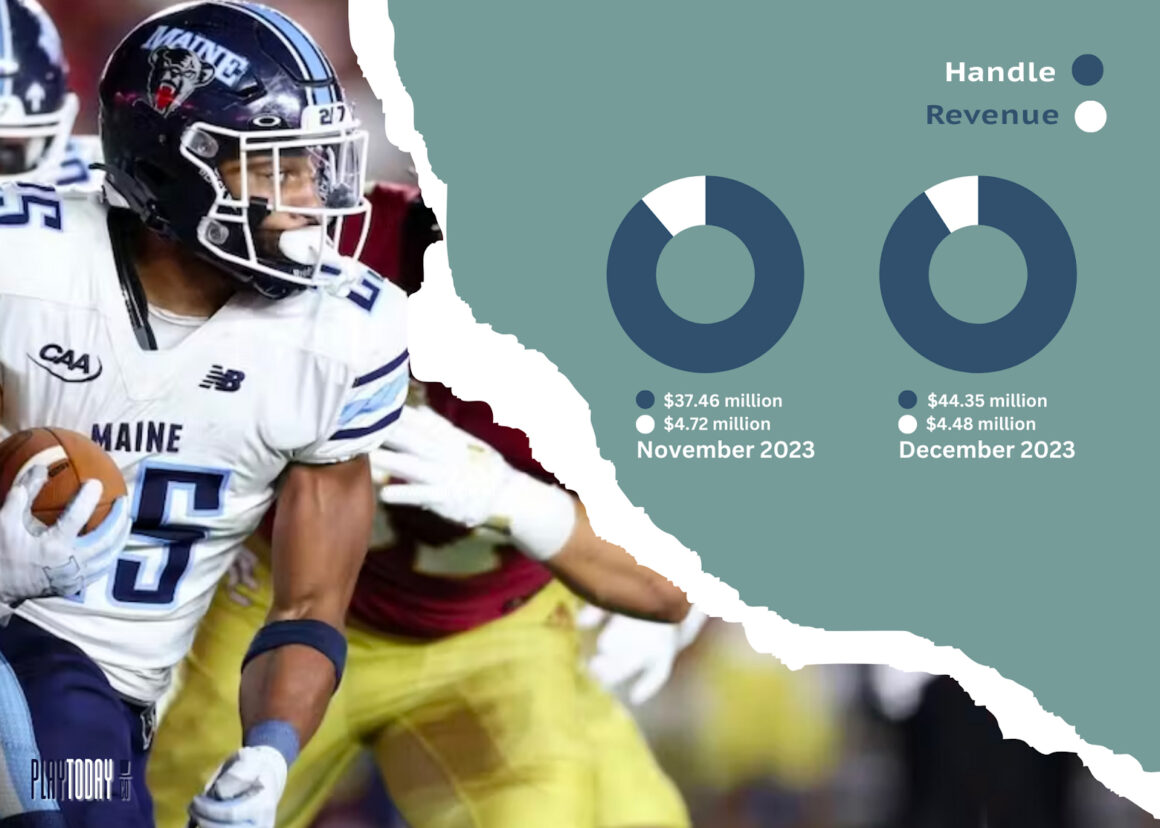

Maine

On November 3, 2023, Maine became the fifth US state to legalize sports betting. During the launch, the state announced it would only allow two online sportsbooks to operate: Caesars and DraftKings.

Two months after the launch, Maine had a total handle of $81,822,613 and a revenue of $9,210,353.

| Online Tax | 16% |

| Retail Tax | 10% |

| Effective Tax | 7.15% |

| License Fee | – Online: $200,000 every 4 years – Retail: $40,000 |

| Model | Multiple, mobile, and retail |

| State Regulator | Maine Gambling Control Unit |

Quick Tip

The minimum age to legally gamble on sports in Maine is 21. On the other hand, anyone at the age of 18 can already qualify for the state lottery.

Maryland

The Free State authorized sports gambling in 2020. After two years, the operators fully launched and went live on November 23, 2022, allowing up to 60 mobile sportsbooks.

As of February 2024, the state has 12 betting sites and 10 retail sportsbooks. Bettors must be at least 21 to participate in wagering, while 18 years and above can wage for eSports already.

| Online Tax | 15% |

| Retail Tax | 15% |

| Effective Tax | 14.8% (retail) |

| License Fee | $50,000 to $2,000,000 |

| Model | Multiple, mobile, and retail |

| State Regulator | Maryland Lottery and Gaming Control Agency |

Fun Fact

The “Free State” had a soft launch on November 21, 2022, and went offline the next day. On Wednesday at 9 AM ET, the state relaunched sports betting on November 23, 2022.

Massachusetts

The Bay State sanctioned sports betting on January 31, 2023. The state’s casinos can partner with two online operators, while racetracks can partner with one only.

Eight online sportsbooks went live in less than two months after the launch. Regulators are against eSports wagering, but wagers on popular celebrity awards are accepted.

| Online Tax | 20% |

| Retail Tax | 15% |

| Effective Tax | 10% (retail) |

| License Fee | – $200,000 (online)- $40,000 (retail) |

| Model | Multiple, mobile, and retail |

| State Regulator | Massachusetts Gaming Commission |

Fun Fact

Betting on horse and dog racing has always been legal in Massachusetts since 1984.

Michigan

The Wolverine State’s sports betting market started in March 2020, introducing two retail sportsbooks: Greektown Casino and MGM Grand Detroit. In January 2021, online gambling regulations commenced, allowing 10 online sportsbooks.

Retail sportsbook betting is available in 22 out of 26 casinos in Michigan. Bettors can sign up online but must provide their social security number.

The minimum age requirement for bettors varies since some tribal casinos permit gamblers at least 18 years old.

Here is the list of casinos allowing 18-year-old bettors:

- Leelanau Sands Casino

- Saganing Eagles Landing Casino

- Ojibwa Casino

- Island Resort & Casino

- Bay Mills Casino & Resort

- Hannahville Potawatomi Bingo and Casino

| Online Tax | – Tribal: 8.4%- Commercial: 9.65% |

| Retail Tax | 8.4% |

| Effective Tax | 3.4% |

| License Fee | $150,000 |

| Model | Multiple, mobile, and retail |

| State Regulator | Michigan Gaming Control Board |

Helpful Article

Michigan is the second biggest online gambling market in the US, overtaking New Jersey in iGaming revenue by a margin of $115,513.

Explore more about the Wolverine State’s competitive online betting scene and see how vital the market is to Michigander, especially for its education sector.

Mississippi

The Magnolia State was among the first areas to launch sports betting without passing new legislation. In June 2018, the Mississippi Gaming Commission (MGC) released the sports betting regulations and launched BetMGM two months later.

Winnings in any MS casinos automatically withhold 3%. Although payouts are taxable in federal, the state doesn’t require its residents to file and report their wins as income.

| Online Tax | N/A |

| Retail Tax | 8% |

| Effective Tax | 8% |

| License Fee | None |

| Model | Multiple and retail |

| State Regulator | The Mississippi Gaming Commission |

Montana

Montana legalized sports betting in March 2019. One year later, the industry was available on the market with one online sportsbook, Sports Bet Montana.

The sportsbook only operates in over 1,800 retail lottery locations. Although online, the state still requires its bettors to be onsite to place their bets.

| Online Tax | None |

| Retail Tax | 8.5% |

| Effective Tax | 100% for every kiosk placed with a gambling operator |

| License Fee | $50 (one time) |

| Model | Lottery Monopoly |

| State Regulator | Montana Lottery Commission |

Nebraska

In May 2021, Nebraska legalized retail sports betting. Bettors can place their wages at any of the six local racetracks and five tribal casinos.

Unfortunately, the state has yet to allow online betting. In-person registration is required to participate and start betting.

| Online Tax | N/A |

| Retail Tax | 20% |

| License Fee | $2,000 – $5,000 |

| Model | Retail only |

| State Regulator | Nebraska Racing and Gaming Commission |

Side Note

Gamblers in the online and crypto gaming industry have tried several games. One game that stuck out among the ocean of betting games is Crypto Mines.

The Mines game combines the mechanics of the classic Minesweeper game with the provably fair system to provide bettors with a fun and nostalgic gambling experience.

Nevada

Nevada was one of the US states unaffected by the previous federal ban on sports betting. It was in 1949 when the Silver State legalized sports betting, 18 years after gambling became legal in the state.

NV is the homecourt of two well-known gambling cities: Reno and Las Vegas. With the two cities, the Silver State is named the gambling powerhouse in the United States.

- Reno was the first city in the US to be called the gaming center. The state is known for its gaming industry tourism and is tagged as the “Biggest Little City in the World.”

- Las Vegas is known worldwide for its bright and glittery casinos, with Las Vegas downtown as the new casino core. The city is dubbed “The Sin City.”

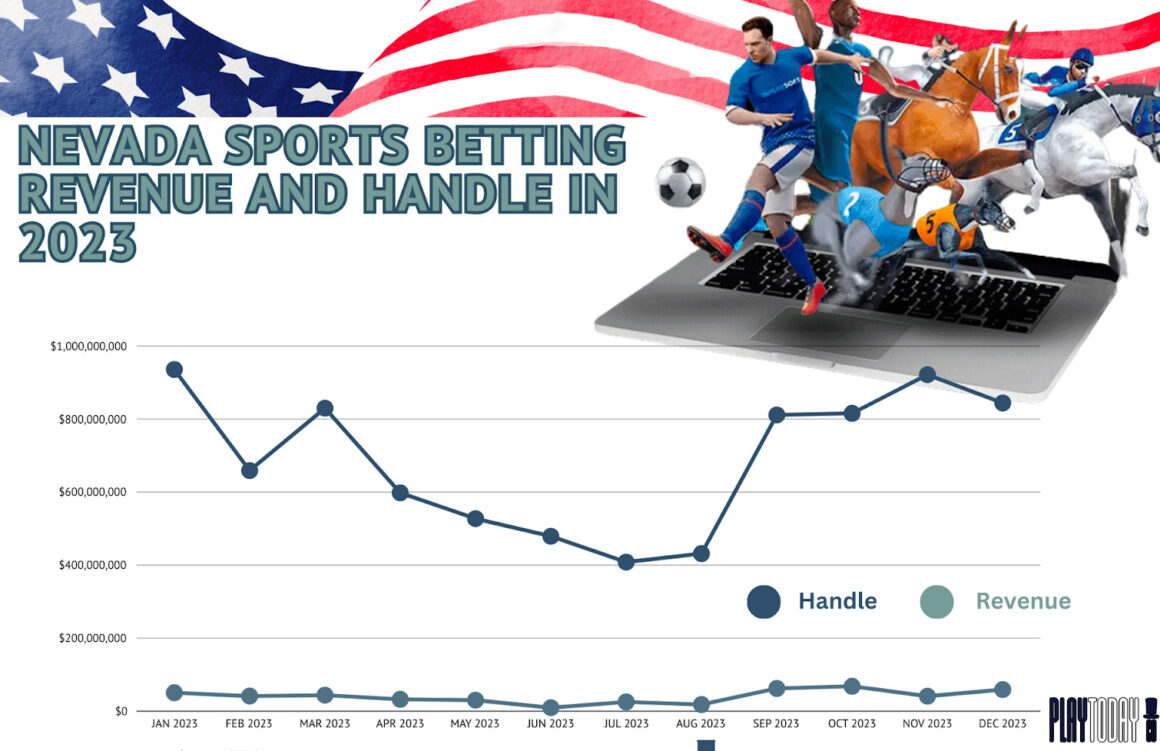

With over 50 retail sportsbooks, the state had a prominent monthly handle, amounting to:

- 2021: $8.14 billion

- 2022: $8.63 billion

- 2023: $7.41 billion (excluding December 2023 handle)

| Online Tax | 6.75% |

| Retail Tax | 6.75% |

| Effective Tax | 6.75% |

| License Fee | $500 |

| Model | Multiple, mobile, and retail |

| State Regulator | Nevada Gaming Control Board |

New Hampshire

New Hampshire legalized sports betting on July 12, 2019, with a minimum age requirement of 18 years and above. DraftKings secured the exclusivity agreement with the state of New Hampshire.

The state has a hefty tax rate of 51%, among the highest in the US. In 2023, the sports betting revenue in New Hampshire reached over $36.86 billion, experiencing a 54.12% growth from 2022 revenue share.

| Online Tax | 51% |

| Retail Tax | 50% |

| Effective Tax | 46% |

| License Fee | Fees go through a competitive bidding process |

| Model | Lottery Monopoly |

| State Regulator | New Hampshire Lottery Commission |

New Jersey

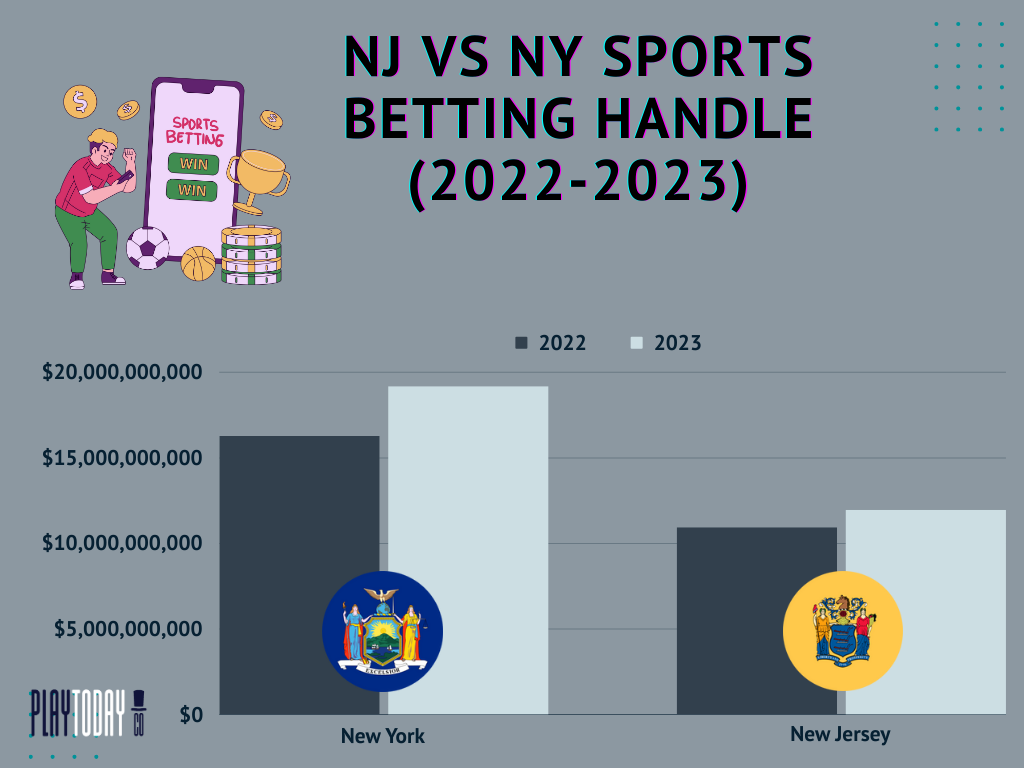

The Garden State authorized its sports betting market in June 2018. After over 3 years, NJ became the sports betting capital of the US when it successively hit a billion-dollar handle.

From September 2021 to January 2022, NJ’s monthly total bets were over $1 billion. Bettors wagered more in the state due to NJ’s lenient and liberal gambling laws.

Here are some notable NJ achievements:

- 2019: Sportsbooks earned a substantial wage of $4.6 billion.

- 2020: Bettors wagered nearly $1 billion in December alone.

- 2021: NJ became the first state to reach a $10 billion sports betting handle.

- 2022: Sports betting handle in one month is $1.35 billion

| Online Tax | 14.25% |

| Retail Tax | 9.75% |

| Effective Tax | 12.5% |

| License Fee | $100,000 |

| Model | Multiple, mobile, and retail |

| State Regulator | New Jersey Division of Gaming Enforcement (DGE) |

Did You Know?

New Jersey defied the sports betting ban law at the federal level. In 2012, NJ passed a law permitting sports betting. However, the Supreme Court declined the legislation.

It was in 2014 when the state passed again a new law that repealed certain sports betting restrictions.

New Mexico has had no formal law regarding the state’s legalization of sports betting since October 2018. However, out of 28 tribal casinos in New Mexico, five offer sports wagers.

The residents of New Mexico are free to gamble on sports but must be physically present to place a wager. Hence, online sports betting is prohibited.

| Online Tax | N/A |

| Retail Tax | Non-profits: 10%; Commercial entities: 26% |

| Effective Tax | 46.25% |

| License Fee | N/A |

| Model | Tribal |

| State Regulator | New Mexico Gaming Control Board |

New York

The Big Apple’s online sportsbooks launched on January 8, 2022. In one month of operation, the NY surpassed New Jersey’s $1.3 billion handle, stealing the latter’s “US Sports Betting Capital” title.

By monthly handle, the Big Apple has become the US’s biggest sports betting market, with a total revenue of $1.6 billion in January 2022. Among US states, NY imposes a heavier tax rate on sports betting at 51%.

| Online Tax | 51% |

| Retail Tax | 10% |

| Effective Tax | 42.3% |

| License Fee | – Initial: $25 million- Annual: $2.5 million |

| Model | Multiple, mobile, and retail |

| State Regulator | New York State Gaming Commission |

Did You Know?

Despite fewer NFL playoff games, New York sports betting weekly handle reached over $490.7 million on January 21, 2024.

North Carolina

The Tar Heel’s in-person sports betting opened in 2019. It took two years for the state to have its first legal wagers. Bettors can wager at any of the three authorized tribal casinos.

Online and mobile sports betting legislation commenced on January 8, 2024. Regulators set a deadline of January 26, 2024, for the applicants for the interactive betting licenses.

| Online Tax | 18% |

| Retail Tax | 18% |

| License Fee | N/A |

| Model | Tribal |

| State Regulator | North Carolina Lottery Commission |

North Dakota

North Dakota’s betting industry legally opened in December 2021. The provisions for the state’s gambling laws require bettors to wager in person in any of the three tribal casinos:

- Dakota Magic Casino

- Dakota Connection

- Dakota Sioux

To purchase a lottery ticket in the state, gamblers must reach the minimum age requirement of 18. For wagers on horse racing or entering a casino, bettors must be 21 years old and above.

| Online Tax | N/A |

| Retail Tax | Tribal only |

| Effective Tax | N/A |

| License Fee | N/A |

| Model | Tribal |

| State Regulator | Ohio Casino Control Commission |

Ohio

In December 2021, the Ohioan government legislated the sports betting bill. On January 1, 2023, the Buckeye State officially launched its sports betting scene.

The legal age to wager is 21 years old and above. Bettors must be physically present at any of the state’s four casinos and seven racinos to participate in gambling.

| Online Tax | 20% |

| Retail Tax | 20% |

| License Fee | $500,000 to $3.3 million |

| Model | Multiple, mobile, and retail |

| State Regulator | Ohio Casino Control Commission |

Oregon

Horse racing has always been popular in Oregon. Since 1997, the state has allowed out-of-state race betting. In 2024, bettors can wage to any five locations for live horse racing.

Remote registration is available to bettors. However, there is only one sports betting app. The state holds 8.9% on every payout, higher than its neighboring state, Nevada.

| Online Tax | 8% |

| Retail Tax | 8% |

| Effective Tax | 8% to 24% |

| License Fee | N/A |

| Model | Lottery Monopoly |

| State Regulator | Oregon State Police: Gaming Enforcement |

Pennsylvania

In 2017, Pennsylvania sports betting officially opened. It took over a year for a sportsbook to operate. Hollywood Casino was the first casino to accept sports bets in November 2018.

Bettors can wager at any of the 13 sportsbooks in PA. Online sportsbooks must partner with any of the state’s 17 available brick-and-mortar casinos for remote registration.

Due to the convenience Keystone State’s betting laws and taxing scheme offer, the state generated a total handle of $7,682,694,849 in 2023.

| Online Tax | 36% |

| Retail Tax | 36% |

| Effective Tax | 24.6% |

| License Fee | $10,000,000 |

| Model | Multiple, mobile, and retail |

| State Regulator | Pennsylvania Gaming Control Board (PGCB) |

Did You Know?

In November 2023, PA State Troopers broke a car window to rescue a one-year-old baby locked in a vehicle. The guardian left the car to gamble at Valley Forge Casino Resort, with an outside temperature of 84° F.

As a consequence, the PGCB placed the male guardian on the Permanent Involuntary Exclusion List, banning him from all casinos in the US.

Rhode Island

Rhode Island is among the US states with the highest tax rate, at 51%. The state’s sports betting commenced in June 2018 and opened five months later. Only on July 28, 2020, did the state lift the ban on in-person sports bets.

The state has one online sportsbook, Sportsbook Rhode Island. Remote registration has been available since the state issued new legislation in 2020.

Sports betting is available at two state casinos, the RI Lottery outposts. The deal is they pay the state a 51% tax rate while the state provides more support and equipment.

| Online Tax | 51% |

| Retail Tax | 51% |

| Effective Tax | 51% |

| License Fee | N/A |

| Model | Multiple, mobile, and retail |

| State Regulator | Rhode Island Lottery |

South Dakota

Retail betting was the only legal form of gambling in South Dakota in 2020. However, the state legalized sports betting in September 2021.

Legal in-person sports betting launched in South Dakota in September 2021. The state’s sports betting handle reached over $1 billion in October 2023 for the first time since its launch.

| Online Tax | N/A |

| Retail Tax | 9% |

| License Fee | $2,000 |

| Model | Retail only |

| State Regulator | South Dakota Commission on Gaming |

Tennessee

Tennessee began its online sports betting market on November 1, 2020, allowing unlimited licenses. Regulators adopted permanent online bets only on March 10, 2022.

The Volunteer State initially set its tax rate to 20%. However, the 2023 legislation changed the rate to a 1.85% tax on each operator.

| Online Tax | 1.85% (tax every dollar, not revenue) |

| Retail Tax | N/A |

| License Fee | $700,000 |

| Model | Mobile |

| State Regulator | Tennessee Sports Wagering Advisory Council |

Vermont

Vermont’s sports betting legally opened on January 11, 2024. The state allows up to six betting licenses, with a minimum age requirement for bettors of 21 years old.

On December 12, 2023, Vermont regulators approved three sports betting operators out of five applications.

The online sportsbook bettors can choose from are:

- FanDuel

- DraftKings

- Fanatics Sportsbook

Operators are subject to a revenue tax of 20%. The individual tax rate is 6%, while out-of-state bettors have a 7.25% tax rate.

Bettors can sign up remotely and wage on eSports and out-of-the-state college sports tournaments.

| Online Tax | 20%; then 1.8% |

| Retail Tax | N/A |

| Effective Tax | 6% |

| License Fee | $500,00 |

| Model | Mobile |

| State Regulator | Vermont Department of Liquor and Lottery |

Virginia

Online sports betting initially opened in Virginia in January 2021. In the first year of the business, the state acquired $58,896,564. Eighteen months later, retail sports betting followed, with a tax rate of 15%.

Remote registration is legal for 16 sportsbooks in Virginia. Bettors must be at least 21 years old to participate in waging.

| Online Tax | 15% |

| Retail Tax | 15% |

| Effective Tax | 7.1% |

| License Fee | $250,000 |

| Model | Multiple, mobile, and retail |

| State Regulator | Virginia Lottery |

Quick Tip

The US gambling tax laws require gamblers to report gambling winnings of up to $5,000.

Washington

On September 9, 2021, Washington officially launched its sports betting market, which is exclusively legal in the state’s tribal casinos. These native casinos consist of 14 retail sportsbooks open to the public.

The state’s minimum betting age is 18. If the establishment sells alcohol, the age requirement is 21 years old. Although Washington does not collect a gambling tax, sports betting payouts are subject to income tax.

Operators withhold tax of 25% of all winnings, provided that the bettors give their SSN. Else, the tax rate goes up to 28%.

| Online Tax | N/A |

| Retail Tax | Tribal |

| Effective Tax | None |

| License Fee | None |

| Model | Tribal |

| State Regulator | Washington State Gambling |

Washington DC

The Washington DC government signed its sports betting bill on January 19, 2019. After over a year of legalization, the sports betting market commenced on May 28, 2020.

Bettors can gamble on the three legal betting sites. The app and website are run by the DC Lottery and regulated by the DC Office of Lottery and Gaming.

| Online Tax | 10% |

| Retail Tax | 10% |

| Effective Tax | 10% |

| Class A License Fee | – Initial: $500,000- Renewal: $250,000 |

| Class B License Fee | – Initial: $100,000- Renewal: $50,000 |

| Model | Multiple, mobile, and retail |

| State Regulator | DC Office of Lottery and Gaming |

Quick Tip

Remote registration is exclusive to GambetDC only. The other online and mobile sportsbooks–BetMGM and Caesars Sportsbook–require onsite registration.

West Virginia

On March 2, 2018, West Virginia passed robust regulations for its sports betting industry. The state officially launched the market on August 26, 2019.

The Mountain State’s lenient betting regulation allows eSports and college sports bets. Bettors at least 21 can place bets on nine betting sites. With lenient regulations and multiple betting options, the state’s gambling revenue has been consistent in figures. In 2023, the revenue reached almost $2.5 million, with the highest recorded revenue of $6.3 million.

| Online Tax | 10% |

| Retail Tax | 10% |

| Effective Tax | 8.5% |

| License Fee | $100,000 |

| Model | Multiple, mobile, and retail |

| State Regulator | West Virginia Lottery |

Did You Know?

On January 15, 2024, West Virginia Delegate Shawn Fluharty introduced a new bill, the HB4700. The bill aims to ban bettors from harassing or threatening athletes, coaches, or sports officials.

Wisconsin

The Badger State has one betting site, which legally operated on November 30, 2021. The state requires its bettors to register in person, exclusive to Oneida Casino in Green Bay.

The state’s legal gambling age for charitable games and the state lottery is 18. However, for tribal casinos, the minimum age requirement is 21.

WI doesn’t have a regulatory body for sports betting. Instead, three native tribes control the state’s gambling industry, namely:

- Oneida Indian Nation

- St. Croix Chippewa

- Potawatomi Nation

| Online Tax | 7.65% |

| Retail Tax | 7.65% |

| License Fee | N/A |

| Model | Tribal – Retail |

| State Regulator | None |

Did You Know?

An 18-year-old Wisconsinite named Joseph Garrison hacked the WI DraftKings site on November 2023. Garrison and his fellow conspirators initiated a “credential stuffing attack” and accessed around 60,000 accounts.

The hackers added a new payment method to the accounts and withdrew about $600,000 from 1,600 accounts. The group was caught and charged with a maximum sentence of 20 years in prison.

Wyoming

The Equality State permitted sports betting on April 5, 2021. Five months later, online sportsbook operators went live on September 1, 2021.

WY only allows online sportsbooks with a maximum of five sports wagering licenses. Despite no retail sportsbooks, the state accumulated a combined handle of $172,247,302 in 2023.

As of February 2024, Wyoming boasts four legal sports betting sites, among the best in the nation:

- DraftKings

- FanDuel

- BetMGM

- Caesars

| Online Tax | 10% |

| Retail Tax | None |

| Effective Tax | 3.1% |

| License Fee | $100,000 |

| Model | Mobile |

| State Regulator | Wyoming Gaming Commission |

Sports Betting Tax Revenues per US State

In 1992, PASPA banned sports betting in the US. The measure excluded seven specific states that already had legal sports gambling before the Act went into effect. After 25 years, the US government repealed PASPA.

Five states immediately enforced a law to legalize sports betting in the same year. Each state had a good start in its first month of sports betting handle.

- Mississippi: $7,696,051

- Delaware: $7,003,725

- Pennsylvania: $1,414,587

- West Virginia: $305,192

- Rhode Island: $682,714

In 2023, the US sports betting market amounted to over $9.48 billion. The main contributor was New York, which has accumulated over $1.5 billion in revenue.

Before diving into the different states’ tax revenues, let’s define some terminologies:

| Definitions: |

| 1. Handle refers to the total amount wagered on sports. |

| 2. Revenue reflects the gross gaming revenue sportsbooks keep after paying out winning bets. |

| 3. Hold percentage highlights how much revenue sportsbooks keep as a function of the gambling handle. |

| 4. State tax revenue displays taxes collected by the state and local jurisdictions. |

New Jersey

The Garden State fought against PASPA by repealing the ban on sports betting. It was a long fight, and after numerous attempts, the state finally claimed victory in 2018.

Shortly after the US government overturned PASPA, NJ legally opened sports bets. The state proved that sports wagers are profitable when NJ reached a $1 billion gross revenue in 2023.

Despite the pandemic forcing casinos to shut down, NJ sports betting gross revenue increased by 33.01% compared to 2019. The game changer was the state’s online betting, allowing residents to register online.

| YEAR | HANDLE | GROSS REVENUE | AVERAGE HOLD | STATE TAX REVENUE |

| 2018 | $1,247,307,720 | $94,022,393 | 10.07% | $11,601,261 |

| 2019 | $4,582,898,150 | $299,398,035 | 6.46% | $40,268,621 |

| 2020 | $6,012,531,987 | $398,231,302 | 6.84% | $54,982,359 |

| 2021 | $10,927,585,885 | $814,981,641 | 7.57% | $112,736,461 |

| 2022 | $10,944,593,978 | $762,954,971 | 7.31% | $107,425,899 |

| 2023 | $11,972,320,289 | $1,006,681,602 | 8.86% | $141,517,468 |

| TOTAL | $45,687,238,009 | $3,376,269,944 | 7.85% | $468,532,069 |

Pennsylvania

Pennsylvania was the fourth state to legalize sports betting in 2018. The sports betting market has grown since 2019, with a high tax rate of 36% accounting for a revenue of over $111 million.

The Keystone was among the US states that thrived during the pandemic, with a gross revenue of $269,903,946 in 2020. The main driver of its sports betting industry was online sportsbooks, which accounted for 94% of wages.

Though PA overcame 2020, the state experienced a negative tax record in February 2022, gaining over $22 million in gross revenue. Still, the operators had a sports betting loss, resulting in a negative $159,425 tax.

| YEAR | HANDLE | GROSS REVENUE | AVERAGE HOLD | STATE TAX REVENUE |

| 2018 | $17,587,677 | $2,516,589 | 24.20% | $905,972 |

| 2019 | $1,490,167,111 | $111,726,711 | 8.33% | $30,280,668 |

| 2020 | $3,580,864,477 | $269,903,946 | 7.48% | $68,293,064 |

| 2021 | $6,552,109,118 | $505,523,748 | 7.84% | $122,438,695 |

| 2022 | $7,251,428,758 | $597,364,960 | 8.38% | $144,434,920 |

| 2023 | $7,682,694,849 | $686,856,678 | 9.18% | $165,101,882 |

| TOTAL | $26,574,851,990 | $2,173,892,632 | 10.90% | $531,455,201 |

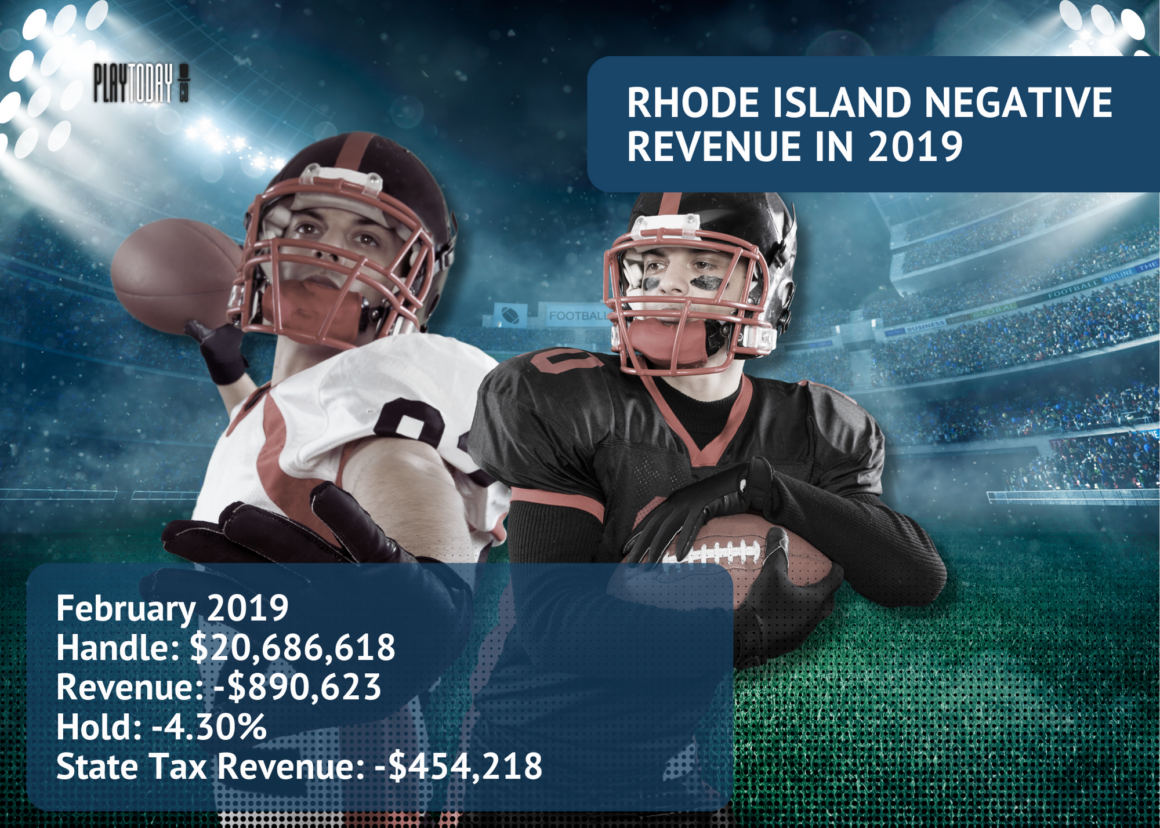

Rhode Island

Rhode Island is one of the states that legalized gambling right after the US government lifted the ban. RI bettors have limited options to wager, allowing two retail sportsbooks and one online betting platform. In February 2019, the casinos in RI lost $890,623 on sports betting. The state lottery paid out the winning bets of nearly $21.6 million for the Super Bowl and other professional sports. On the other hand, the total wage was only $20.7 million.

The Ocean State’s sports betting market started growing in March 2019. Fluctuations happened, but the industry thrived despite the effects of the pandemic, with the state gaining 51% of revenue.

| YEAR | HANDLE | GROSS REVENUE | AVERAGE HOLD | STATE TAX REVENUE |

| 2018 | $13,770,713 | $1,030,910 | 9.00% | $525,764 |

| 2019 | $245,811,496 | $17,806,694 | 7.45% | $9,081,413 |

| 2020 | $22,770,472 | $24,067,477 | 9.23% | $12,274,413 |

| 2021 | $454,457,990 | $38,751,495 | 8.94% | $19,763,261 |

| 2022 | $532,609,814 | $49,298,062 | 9.31% | $25,142,012 |

| 2023* | $365,101,422 | $32,717,606 | 8.91% | $16,685,978 |

| TOTAL | $1,682,799,701 | $167,085,444 | 8.78% | $85,213,573 |

New York

New York is the most populated state to legalize sports betting. The state was quick to allow sports betting but slow to sanction online bets. Due to COVID-19, New York experienced a monthly loss for the first time.

NY sports betting struggled in 2020, with negative revenue in February and zero income from April to August. However, the sports betting industry strived as soon as the operation resumed in September 2020, generating a tax revenue of $1.4 million.

With the launch of online betting in 2022, the New York sports betting market has flourished. In 2023, the state had collected the most taxes of all time, acquiring over $1.5 billion.

| YEAR | HANDLE | GROSS REVENUE | AVERAGE HOLD | STATE TAX REVENUE |

| 2019 | $67,960,787 | $7,783,423 | 14.68% | $129,724 |

| 2020 | $98,109,146 | $10,768,728 | 9.74% | $1,076,872 |

| 2021 | $97,476,663 | $23,321,149 | 11.92% | $2,332,112 |

| 2022 | $16,288,073,156 | $1,367,052,768 | 8.56% | $693,923,018 |

| 2023 | $19,196,867,479 | $1,697,297,617 | 8.98% | $862,582,466 |

| TOTAL | $35,748,487,231 | $3,106,223,685 | 10.78% | $1,560,044,192 |

Michigan

In March 2020, Michigan launched its sportsbook. A few weeks later, sports betting in Michigan closed due to the pandemic. Online sportsbooks had yet to open at that time, not until January 2021.

Only in the first month of online bets did it have a handling percentage below 80%. The following month, in February 2021, online sports betting rose to over 90%.

The Wolverine State’s sports betting industry has since maintained its increasing gross revenue, with no signs of slowing down.

| YEAR | HANDLE | GROSS REVENUE | AVERAGE HOLD | STATE TAX REVENUE |

| 2020 | $130,763,498 | $18,276,857 | 14.78% | $1,535,256 |

| 2021 | $3,956,906,303 | $319,522,216 | 8.33% | $13,612,812 |

| 2022 | $4,814,088,969 | $418,647,137 | 8.84% | $22,059,404 |

| 2023 | $4,810,903,877 | $434,438,031 | 9.23% | $23,472,229 |

| TOTAL | $13,712,662,647 | $1,190,884,241 | 10.30% | $60,679,701 |

Delaware

Delaware’s sports betting scene has been operating since 2009, among the four grandfathered states with sports wagering exempted under PASPA’s restrictions. After the US repealed PASPA, the Diamond State was the first to legalize sports bets.

In three consecutive years since 2019, Delaware experienced revenue loss. Aside from that, the state had zero income for three months straight during the pandemic.

Despite the negative revenue, the market from 2019 to 2021 was still high. The following years, 2022 to 2023, were experiencing a decrease in revenue.

| YEAR | HANDLE | GROSS REVENUE | AVERAGE HOLD | STATE TAX REVENUE |

|---|---|---|---|---|

| 2018 | $115,351,865 | $21,199,737 | 16.27% | $12,064,786 |

| 2019 | $132,488,380 | $25,847,560 | 15.91% | $14,534,060 |

| 2020 | $90,242,755 | $23,522,330 | 19.54% | $13,725,525 |

| 2021 | $119,650,457 | $23,185,267 | 17.38% | $12,700,997 |

| 2022 | $82,432,393 | $13,990,499 | 14.76% | $10,376,719 |

| 2023 | $65,326,809 | $10,896,745 | 14.93% | $8,437,503 |

| TOTAL | $605,492,659 | $118,642,138 | 16.47% | $71,839,590 |

Colorado

The Centennial State taxes its sports betting operators at a 10% rate of their net revenues. The state also allows licensees a promotional credit deduction. In 2024, operators can only deduct up to 2.5% of their handle.

Listed are the most prominent sports betting brands.

- BetMGM

- BetRivers

- DraftKings

- FanDuel

In 2023, the biggest monthly handle in the state was in November, accounting for $608,488,266. Colorado residents must file a taxable income of 4.6% in their payouts.

| YEAR | HANDLE | GROSS REVENUE | AVERAGE HOLD | STATE TAX REVENUE |

| 2020 | $1,185,754,618 | $75,841,207 | 7.24% | $2,965,322 |

| 2021 | $3,847,527,102 | $250,048,945 | 6.66% | $11,701,499 |

| 2022 | $5,181,758,903 | $351,950,255 | 6.80% | $19,634,715 |

| 2023* | $4,843,802,015 | $351,408,768 | 7.28% | $23,741,103 |

| TOTAL | $15,058,842,638 | $677,840,407 | 7.00% | $58,042,639 |

*December 2023 is not yet included.

Illinois

In October 2022, Illinois became the fourth state to achieve a $1 billion monthly handle. The state sits at the top of the sports betting market in the US. The Prarie State also ranks among the top 10 largest worldwide.

On March 9, 2020, the Prairie State launched its physical sportsbooks. The state’s sports betting industry had zero revenue for the next two months due to the pandemic.

The industry has grown with the state’s legalization of online sports betting on June 18, 2020. When the state allowed in-person registration in March 2022, the revenue reached $1 billion.

| YEAR | HANDLE | GROSS REVENUE | AVERAGE HOLD | STATE TAX REVENUE |

| 2020 | $1,882,620,542 | $137,410,656 | 8.14% | $20,191,143 |

| 2021 | $7,021,763,064 | $534,086,819 | 7.79% | $84,691,181 |

| 2022 | $9,751,301,251 | $806,195,859 | 8.23% | $127,668,464 |

| 2023* | $10,268,204,526 | $882,389,078 | 8.73% | $140,599,237 |

| TOTAL | $28,923,889,383 | $2,360,082,412 | 8.22% | $373,150,025 |

New Hampshire

NH’s sports betting has continuously grown since its launch in December 2019. Despite the pandemic, the state’s sports betting significantly grew, amounting to over $292.55 million.

After robust year-over-year growth in handle, the market experienced a decline of 7.85% in 2023 from the previous year. However, with a hefty tax rate of 51%, the gross revenue was unaffected by the decrease in total bets.

In 2023, the Granite State had a gross revenue of $80.28 million, a 20.34% increase compared to 2022.

| YEAR | HANDLE | GROSS REVENUE | AVERAGE HOLD | STATE TAX REVENUE |

| 2019 | $360,726 | $44,759 | 12.40% | $19,403 |

| 2020 | $292,550,269 | $23,638,791 | 8.00% | $11,012,003 |

| 2021 | $703,899,047 | $43,827,560 | 6.48% | $19,999,601 |

| 2022 | $891,727,580 | $66,714,384 | 7.62% | $30,969,398 |

| 2023 | $821,707,403 | $80,288,654 | 9.70% | $35,572,290 |

| TOTAL | $2,710,245,025 | $214,514,148 | 8.84% | $97,572,695 |

Indiana

Indiana offers one of the lowest tax rates on online sports betting. Basketball is the state’s residents’ sport of choice, drawing $133.1 million in bets.

From March to June 2020, the market value decreased. However, with Unibet gaining market access to Indiana, the 4-month downturn reversed with a 157.94% increase in August 2020.

In 2023, Indiana ranked sixth in gross revenue, accounting for $1.27 million. While November 2023 had the highest handle of over $513.67 million, December had the biggest collected revenue, totaling $54.6 million.

| YEAR | HANDLE | GROSS REVENUE | AVERAGE HOLD | STATE TAX REVENUE |

| 2019 | $435,996,520 | $41,576,946 | 12.45% | $3,931,772 |

| 2020 | $1,769,270,606 | $136,395,416 | 7.57% | $13,165,417 |

| 2021 | $3,829,411,987 | $308,304,353 | 8.15% | $29,089,084 |

| 2022 | $4,467,882,215 | $386,888,311 | 8.83% | $36,797,945 |

| 2023 | $4,337,817,508 | $404,363,766 | 9.50% | $38,417,065 |

| TOTAL | $14,840,378,836 | $1,277,528,792 | 9.30% | $121,401,283 |

Tennessee

Tennessee has imposed a 1.85% tax on gross handle six months after the state’s sportsbook launch. The state doesn’t have a license limitation, and bettors can expect to have additional sportsbooks from the existing 12.

In November 2023, the sports betting market in Tennessee hit a new record, with a monthly handle of $517.14 million and revenue of $51.71 million. After hitting a new record, the market had a 4.27% drop in December 2023.

- Handle: $495,067,783

- Gross Revenue: $49,506,778

| YEAR | HANDLE | GROSS REVENUE | AVERAGE HOLD | STATE TAX REVENUE |

| 2020 | $312,444,523 | $27,124,908 | 8.90% | $5,443,918 |

| 2021 | $2,730,459,000 | $239,872,000 | 9.01% | $39,300,000 |

| 2022 | $3,850,547,906 | $379,409,891 | 9.86% | $68,052,961 |

| 2023 | $4,292,352,235 | $451,028,296 | 10.61% | $83,557,513 |

| TOTAL | $11,185,803,664 | $1,097,435,095 | 9.60% | $196,354,392 |

West Virginia

West Virginia passed laws allowing sports bets before the US Supreme Court. The state anticipated the fall of PASPA and became the fifth state to permit sports betting.

In December 2018, the state was ahead of the curve in launching online sportsbooks. It boosted West Virginia’s sports betting market, resulting in a 30% increase in January 2019.

Sports betting is big in WV despite not having a pro sports team. The state’s first full year of legal sports betting handle reached over $228 million in 2019 and doubled in the next year.

| YEAR | HANDLE | GROSS REVENUE | AVERAGE HOLD | STATE TAX REVENUE |

| 2018 | $47,796,234 | $6,623,563 | 24.70% | $662,356 |

| 2019 | $228,285,426 | $19,434,393 | 8.43% | $1,945,349 |

| 2020 | $400,741,355 | $27,286,723 | 7.19% | $2,728,673 |

| 2021 | $546,940,861 | $45,127,957 | 8.66% | $4,512,797 |

| 2022 | $571,317,850 | $50,822,381 | 9.04% | $5,082,238 |

| 2023 | $429,218,366 | $41,406,171 | 9.75% | $4,140,618 |

| TOTAL | $2,278,309,144 | $197,018,660 | 11.32% | $19,703,778 |

Helpful Article

If you want to know more about why sports betting is popular in West Virginia and how consistent its online gambling trend and growth is, check out the following article: West Virginia Online Gambling Revenue: A Growing Trend.

How Does the US Tax Gambling Winning?

Winnings from any gambling form are subject to taxation. The federal has imposed a 24% winning tax, while the state and territory tax the winners depending on their legislation.

Although bettors will not fully receive the gains, the gambling losses are deductible. Gamblers can also report the money they lose if they can itemize and prove the numbers. Remember that tax deductions have limitations.

The state will also have its tax. But with the deduction, it is possible to avoid the tax payment. For example:

- A gambler wins $5,000 but loses $7,500. Only $5,000 can be deducted. The future win cannot offset the remainder.

- If a gambler spent $4,000 to win $4,000, it would be breakeven, avoiding the tax payment.

Quick Tip

Gambling taxation laws in the US fine non-American residents at a flat rate of 30% on their betting payouts.

If a single winner hits the lottery jackpot of $1.35 billion, the IRS takes a minimum of 24%. Two options will be given to the winner:

- Option 1: Total of $1.35 billion in 30 payments over 29 years

- Federal taxes: $324 million

- Take-home: $1.026 billion (by 2053, from 2024)

- Option 2: A lump sum in cash—$707.9 million is taken

- Federal taxes: $169.896 million

- Take-home: $538 million

Listed are some of the notable mega-million payouts:

| DATE | CASH PRIZE | CASH OPTION |

| October 23, 2018 | $1.537 billion | $877.8 million |

| January 22, 2021 | $1.05 billion | $776.6 million |

| July 29, 2022 | $1.337 billion | $780.5 million |

| January 13, 2023 | $1.348 billion | $723.5 million |

Final Thoughts

Sports betting in the United States has been prevalent since the early 1900s. It has grown over the years, especially since its legalization in 2018.

With almost 40 states legalizing sports betting, the market sees significant expansion from traditional to modern wagering. Despite some hiccups, each state’s sports betting market still survives in most states with its hefty taxation design.

List of sources

- Bet Arizona

- Gaming Today

- WSN

- Sports Handle

- Gambling

- Covers

- Legal Sports Report

- Bet Arkansas

- Forbes

- Playfl

- Sports Handle

- Action Network

- NY Times

- ESPN

- Bet Kansas

- CBS Sports

- USA Today

- American Gaming Association

- Sports Keeda

- Bet Maine

- Forbes

- Statista

- Statista

- American Gaming Association

- USA Today

- Investopedia

- iGaming

- SI

- Play Pennsylvania

- Oddspedia

- National Football Post

- The Sports Geek

- Vixio

- Winston

- Sports Data

- Bet Tennessee

- Play USA

- Illinois Bet

- Play Illinois

- Bet Colorado

- Sports Book Review

- Michigan Gov

- Play Michigan

- Sports Betting Dime

- Providence Journal

- Line Ups

- Columbia Library Journal

- Springer

- MS Gov

- The Tennessean

- House Bill 551

- Bet Michigan

- Iowa Law

- CT Gov

- Forbes

- NY Post

- Sportshandle

- Job Monkey

BC.Game

BC.Game  7Bit

7Bit  Ducky Luck

Ducky Luck  Red Dog

Red Dog